Tag: wisdom

Planning for Uncertainty

April 24, 2025by Ron Bare

Early in my career I remember hearing that it is wise to plan for the “Certainty of Uncertainty”. As a financial advisor, this really resonated with me. Reflecting on that phrase now, after 30 years of experience, including various times of uncertainty, I firmly believe in the truth of that wisdom. When economic or market uncertainty is elevated, we believe in the importance of going back to values and principles to help you make wise financial decisions. And here at Bare Wealth Advisors, we believe the best values and principles to apply are those that are grounded in Biblical wisdom. Here are a few to consider during times of greater uncertainty:

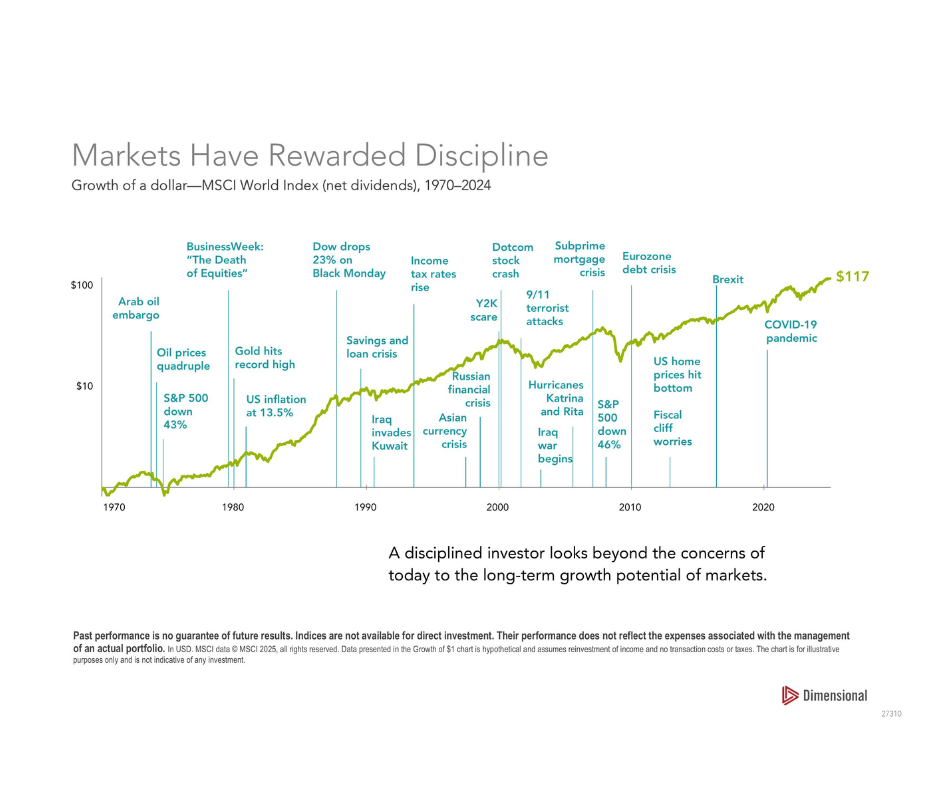

- Think Long-Term. A long-term perspective is very important to consider when thinking about investment decisions. The longer your perspective is, the better financial decisions you will typically make. Investing in the ownership of companies (which is what you do when you invest in the stock market) carries risks of economic and financial events. When you step back and look at the long term, investors are often rewarded for the risks taken. (Proverbs 13:11, 28:19-20)

- Diversify your investments. In our planning process we intentionally build our portfolios across various industries, sizes of companies and countries to help ensure diversification. We use various professional managers with many years of experience. In addition, we typically hold 5+ years of cash needs (or income) in more conservative investments that are not subject to as much market volatility in the short term. This allows investors to apply principle #1 – think long-term. (Ecclesiastes 11:1-2)

- Minimize debt. When a company or individual has minimal debt levels it reduces risks to their overall plan and future when uncertainty happens. (Proverbs 22:7, 26-27)

- Increase Generosity. We talk a lot about generosity at Bare. We believe being generous is one of the most important biblical principles to apply to our finances. Generosity takes a step of faith, it helps us to learn to trust God and be grateful. When we live with open hands and are generous to those in need, we are reminded of how blessed we are. Times of uncertainty are great times to consider how to be a blessing to others. (1 Timothy 6:17-19, 2 Cor. 9)

- Increase Margin. Financial margin can be vastly underrated. When you have margin in your monthly income and margin on your balance sheet it gives you a chance to take advantage of market volatility. Most people have heard the phrase “buy low – sell high,” but many are not prepared with margin to implement this when opportunity arises. (Proverbs 6:6-8). A good way to increase margin is to live within a budget to ensure that you have excess money to save and invest each month. Additionally, it is helpful to hold some cash in a reserve account for unexpected expenses as well as unexpected opportunities.

As always, we are here to talk to you about your personal financial and investment plans. We care about you and your family and remain committed to helping you steward your resources according to your God-given purpose; assisting you to make a significant difference in this world! I will leave you with a few quotes from two famous and successful investors:

Warren Buffet – “If you aren’t willing to own a stock for 10 years, don’t even think about owing it for 10 minutes”

John Templeton – the four most dangerous words for an investor “This time is different”

Staying the Course During Market Volatility

April 8, 2025by Ron Bare

Along with most Americans, we’ve been watching closely as President Donald Trump declared April 2nd to be “Liberation Day” and implemented broader tariffs than anticipated by economic watchdogs and television pundits. These tariffs, which include a 10% duty on all imports to the U.S. and meaningfully higher rates for some countries in particular, have had an immediate negative impact on the markets and led to concerns about a potential recession and increased market instability.

As always in times of such volatility, it’s natural to feel anxious about your investments. The rapid swings in stock prices can stir emotions, but it’s essential to remember that historically markets have demonstrated resilience over the long term, even in the face of policy-induced volatility.

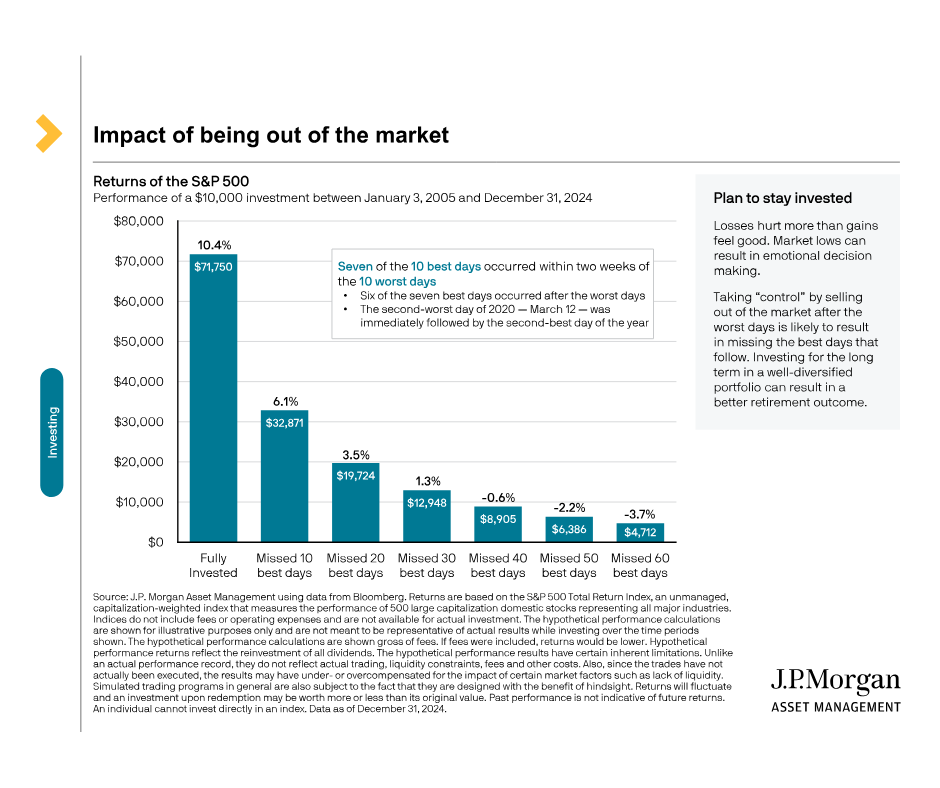

J.P. Morgan Asset Management’s oft-quoted research illustrates the importance of staying invested through turbulent periods. In one study, they analyzed the performance of a $10,000 investment in the S&P 500 between January 2004 and December 2023. If the investor stayed fully invested, the average annual return was 10.4%. However, missing just the 10 best days during that period cut the return to 6.1%. Missing the 20 best days dropped it further to 3.5% (see the data here). The impact of being out of the market for even a few key days—most of which tend to occur during periods of heightened volatility—can be dramatic.

“The stock market is a device for transferring money from the impatient to the patient” – Warren Buffett.

As the ‘Oracle of Omaha’ reminds us in the above quote, it’s important to keep in mind the psychological impact of market volatility. Behavioral finance studies suggest that the pain of losses often feels more intense than the pleasure of gains—a concept known as loss aversion. This can lead to panic selling, which often locks in losses and prevents investors from participating in subsequent market recoveries. Staying focused on your long-term goals and resisting the urge to make hasty decisions can help you avoid these pitfalls.

While this is the largest wave of American tariffs since President Hoover signed the Smoot-Hawley Tariff Act in 1930, it’s essential for us to maintain a long-term perspective. Reacting in fear or attempting to time the market during such periods can lead to missed opportunities and diminished returns. By staying the course and focusing on your long-term investment objectives, you position yourself to navigate through this volatility more effectively. Please see below for helpful graphic information on the value of staying the course.

As always, our team is here to support you in aligning your investment strategy with your financial goals, helping you navigate these uncertain times. Be on the lookout for additional communications and resources from our office in the coming days. In the meantime, we are available to talk if you’d like to reach out and discuss anything on your mind.

Helping You Plan Well for Retirement

March 19, 2025

by Adam Black

Retirement is a significant milestone in American culture – a chance to reflect on your life’s journey and accomplishments. As you reflect, looking back in the rear view mirror of your life, what do you hope to see?

This year at Bare, our theme is Year of Increase. We believe in helping you expand your vision for all that you’ve been entrusted to steward. Many of us understand the call to steward our resources, but Matthew 25 reminds us of the call to also increase what we have been given! How can we plan well for retirement and increase our resources, so that we can serve our families and communities?

Planning for retirement can feel overwhelming, but taking time to make informed decisions is the key to being set up for a secure future. Inviting a financial advisor into this process can help make the process smoother. Today, we’ll answer 3 common retirement questions, to help us all approach retirement with confidence, clarity, and a vision for increase.

- At what age should I take my Social Security?

Social Security has been a hot topic in the news recently! I’ll be the first to admit that I don’t know what will happen with it over the coming years. What I do know is that it can play a large role in any retirement plan. When is the best time to take Social Security? It varies, but before a decision can be made, it’s important to understand some of the rules.

Social Security can be taken as early as age 62. It is important to note, however, that taking Social Security at 62 will result in a reduction of your Full Retirement Age benefit for the rest of your life. Full Retirement Age for most people today is age 67, which is when you are entitled to your full benefit. The latest age that Social Security can be taken is age 70. For each year that you delay your benefit from Full Retirement Age until age 70, you will get an 8% increase on your benefit for the rest of your life as long as you were born after 1943.

If you plan on retiring on the earlier side, it may make sense to take your Social Security benefit, but if you never plan on slowing down (I’m looking at you, farmers), it may make sense to get the largest possible benefit by waiting until 70. If you have a family history of health concerns, you may want to collect earlier to get benefits for more years, but if you plan to live until 100, you will receive more money over your lifetime by delaying. Everyone’s financial, health, and retirement goals are different, so inviting a trusted financial advisor into this process can help you maximize your Social Security benefits.

- What do I do about health insurance?

For those retiring at 65 or later, Medicare most likely is the answer. After all, you have been paying into it for nearly all of your working life – you might as well take advantage of it! Medicare is made up of a few parts that each serve different purposes.

Medicare Part A is hospital insurance. It covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health services. Most people don’t pay a premium for Part A because they paid Medicare taxes while working.

Medicare Part B is medical insurance. Part B covers outpatient services, including doctor visits, preventative care, lab tests, outpatient surgeries, and some home health care. The monthly premium is taken directly from your Social Security benefit if you are collecting. Most people do pay deductibles and copays for services.

Medicare Part C, or Medicare Advantage, are private plans that offer all the benefits of Parts A and B, and additional services (dental, vision, hearing, etc.). Medicare Advantage plans usually include prescription drug coverage and have out-of-pocket cost limits, so it could be a more advantageous health coverage option for you.

Medicare Part D helps cover the cost of prescription medications, either through stand-alone prescription drug plans or as part of a Medicare Advantage plan.

Finally, Medicare Supplement Insurance, or Medigap, helps pay for out-of-pocket costs like copayments, coinsurance, and deductibles.

- Are my investments protected?

It’s understandable that retirees may worry whether their hard-earned nest egg will lose value, especially when they have no plans to return to work. Any investment outside of cash or an FDIC-insured product like a CD does carry some risk. Yet if all of your investments were cash, they would likely be beat out by the cost of living. So how can you ensure that your money is protected for short-term needs, while making sure it outpaces inflation and lasts a lifetime?

One of our favorite approaches is ‘segment planning,’ which involves defining how much is enough for you in each phase. The first phase aims to protect money from loss of principle that you need in the short term (roughly the next 5 years) by using products like cash and CDs. After this segment is filled, we plan for segment two which are years 6 – 10. For this segment, we often use investment products like fixed annuities or bonds. In segment three, which are years 11+, we look to outpace inflation with higher risk investments that offer a higher growth potential. These investments might include stocks, real estate investments, or growth-focused mutual funds and ETFs. We have seen the stock market grow in most 10-year windows, which gives us confidence to move forward. Even if a segment decreases in value in year one, there is time for it to recover. As you progress, funds from later segments move into the adjacent segment, ensuring that the next few years of necessary funds are available and as close to risk-free as we can get.

There’s a lot to consider in retirement, and I’m sure that this blog raised questions that I couldn’t address today. Retirement planning is a serious endeavor, and many people underestimate how impactful it can be to work with a trusted advisor. I often hear, “I wish I would’ve met with an advisor sooner,” but the key is that they are meeting with one now, instead of 10 years from now. I’d encourage all upcoming retirees to find an advisor who is trustworthy, aligns with your values, and has your best interest in mind. They will help give you confidence to step into retirement, whenever the Lord calls you into that season.

Passing on Biblical Wisdom to the Next Generation

November 1, 2024

By Ron Bare

While stopped at a red light today, the image on the box truck in front of me caught my eye. There, displayed on the back of the truck, was an image of a family enjoying a meal together. All of a sudden, I found myself craving a delicious holiday meal. (Thankfully, those meals are just around the corner.) Even more than those meals, I found myself craving quality family time. That advertisement was sure doing its job! The holidays are a beautiful time to spend time with those you love most, and I hope you get to enjoy the gift of family in just a few weeks.

Not only are the holidays filled with food and family time, but they’re also filled with conversation. What topics of conversation typically fill your table during the holidays? Our conversations often revolve around life updates, stories from work, excitement for the new year, and family memories. As I look ahead to the holidays this year, I wonder if there’s a new topic of conversation we could, and perhaps should, bring to the table.

What would it look like to start intentionally passing on wisdom to our families? I truly believe that passing on wisdom to the next generation is one of the best ways to be faithful with what we have been given. It is a beautiful opportunity to leave a lasting legacy. When those we love can learn from our mistakes without having to make the mistake themselves, it saves time and lowers stress. It allows for room for them to make their own mistakes and grow, while acknowledging the wisdom you’ve already passed on to them.

Wisdom is a common topic throughout the Bible, especially in Proverbs. In Proverbs 2, we read about how to obtain wisdom and how wisdom changes us. Verse 6 reads, “For the Lord gives wisdom.” Where else could it come from? Who else knows all? I am encouraged when I remember that we have direct access to the Lord and can ask Him for wisdom through prayer. Let us rejoice that our God offers us this gift!

When the Lord does graciously choose to grant us wisdom, we see its impact permeate our lives. When we have wisdom, we fear the Lord. When we have wisdom, we gain knowledge that can only come from God himself. He guides us as we live and grants us a sense of right and wrong. Wisdom acts as a shield and a protection from things that we may not have otherwise been aware of, including evil or immoral things.

As we grow older and experience more of life, we tend to grow in wisdom. Each success and failure have something to teach us. With every experience, we gain more wisdom that can be passed on. The Lord has granted these opportunities to us, and I believe that sharing these experiences and wisdom with our children and grandchildren is both an incredible opportunity and responsibility.

As we enter the final months of this year, consider bringing a new topic of conversation to your table. What wisdom can you bestow upon those you love? It might be as simple as asking a few questions. Ask someone in your family, “What is something you have learned this year?” Consider powerful stories from the last few months or years that have shaped your thinking, your principles, and your beliefs. Be prepared to share these things with your family as you share meals together.

Many biblical men and women have prayed for wisdom throughout the years. We look to Moses, whose prayer we hope is the echo of each of our hearts: “Heavenly Father, teach me to number my days that I may gain a heart of wisdom.” I pray that this holiday season, we each desire to both grow in wisdom and share it with those we love.

Biblical Wisdom for Uncertain Times

September 23, 2024By Ron Bare

Uncertainty is a certainty in this world, and if you don’t believe me, turn on the news. This year alone has been filled with plenty of uncertainty – an assassination attempt, war in the Middle East, war in Ukraine, an election, and I could go on.

Uncertainty is inevitable and unpredictable, so how can we prepare for it? What is a biblical understanding of uncertainty? I believe that the Bible provides valuable guidance on this topic. Several biblical principles have guided me in my thinking about uncertainty.

First, in Matthew 7, we read about the wise man who built his house on solid ground to protect against rain and storms. He didn’t know when the rain and storms would come or what they would be like, but he knew they would certainly come, and he prepared for them.

Part of building on solid ground involves significant planning. Luke 14:28 reminds us of the importance of planning our finances. Here at Bare, we listen to your story, values, and goals and then create a personal financial plan for each client. Why? We know that each situation is different, and we want to do our best to set each client up for success in both the good and the challenging times.

Plan as we may, we know disaster still strikes. Ecclesiastes 11:1-2 reminds us of this: “…you do not know what disaster will come.” Notice that it doesn’t say, “you do not know if disaster will come.” Between cash, real estate, equities, and businesses, plans will go awry. Wisdom reminds us that things will be difficult.

In light of difficult times, I’m grateful for a passage in 2 Corinthians that shares a real-life story of generosity in uncertain times. The Macedonians experienced severe poverty, but continued to give generously. 2 Cor 8:2-3 reads, “In the midst of a very severe trial, their overflowing joy and their extreme poverty welled up in rich generosity. For I testify that they gave as much as they were able, and even beyond their ability.” How incredible would it be to follow in that testimony even in times of uncertainty or poverty?

Uncertainty and difficult times can be stressful and disheartening. But what if through it all we could think long-term and stay optimistic? I know, it is not an easy ask. It’s much easier to let the weight of uncertainty cloud our vision. Suddenly, short-term investments or other shortcuts seem like a good option, and we hear messages like “this time is different.” Don’t be fooled; don’t let uncertainty cloud your vision. Continue to hold to your financial plan, seek wisdom from the Bible, and remember “there is nothing new under the sun.” Eccl. 1:9. Staying the course in this area will pay off.

Fear can accompany these feelings of stress, but the parable of the talents in Matthew 25 has spoken to this and helped to ground me. Jesus begs us to remember that we are not the owner of our resources, but rather a steward tasked with working and investing to grow what has been entrusted to us.

As stewards, God has not given us the ability to know the future, and I am honestly glad He has not. We must rely on Him for the future, trusting the teachings that He has graciously revealed to us that guide us toward faithful stewardship. Let us build our lives on solid ground and trust the future to His hands.

At Bare, we encourage you to think in a way that we describe as “beyond abundance.” This is a posture of confidence in God acknowledging that He can richly provide for us beyond what we need so that we can generously share with others. A “beyond abundance” way of living offers freedom and opportunities to live a life of fullness; to impact the world far beyond what we could hope or imagine.

When I experience the uncertainty of our world, I am filled with gratitude for God, who has given us biblical teachings to guide us in the midst of it all. Consider how it might impact your life if you built your life on solid ground, planned your finances with wise counsel, diversified, gave generously, stayed optimistic, and remembered who the true owner is. Let’s live beyond abundance together!

Leaving a Family Legacy of Generosity

June 7, 2024by Ron Bare

My parents taught me to be generous. Throughout my childhood they instilled many values, both in speech and in action – but it was the “action” values that really remained. I don’t remember whether our house was always clean or whether my mom’s meals were always perfectly cooked. But I do remember that she was always feeding not only me, but all of my friends too. I remember my father faithfully tithing. My mom was also generous with her time, volunteering at church and a local thrift shop. I learned by watching her that generosity can be expressed in many forms and that family giving is hugely impactful.

I believe many of us would love to leave legacies of a strong work ethic or faithfully tithing, similar to my parents. We all have a deep desire to impact those around us. So how do we do it?

Last month, we talked about six buckets of long-term goals. We focused on the giving bucket and about what it means to give out of our assets and accumulation. This takes intentional planning and a generous heart.

This month, we’re focused on the family goals bucket. Many of us have a desire within our hearts to support our children or grandchildren. This support comes in different forms depending on our values and lifestyle. We often begin with goals of helping our children financially. These goals typically involve helping with their education, first home, or leaving an inheritance.

In the same way that my parents taught me the many ways to be generous, I’d invite you to consider the many ways to handle family goals. Offering college support or leaving an inheritance aren’t the only ways to support your family. The values and wisdom you instill in your children and grandchildren around finances can be even more valuable than the finances themselves. One of my mentors, Ron Blue, stresses the importance of this concept in a quote he has been known to say, ” Pass on wisdom before wealth.” Your children and grandchildren will continue to think of you after you’re gone. What do you hope comes to their mind? What did they see you model? How did you talk to them about money?

Maybe there are patterns you can establish, like giving first before paying your bills, that your children will pick up on. It could be valuable to also consider a fund that could be started to help fund the dreams and goals of the next generation, including helping them start a business, buy a home or even invest into their giving goals. Consider how your life experiences can be valuable to share. Simply inviting your children into some of your financial conversations can be invaluable. You’ve learned lessons through your successes and failures that have the potential to be a great resource to the next generation.

Part of the reason we encourage thinking about more than just giving financially to our family is because we know that without the values piece, sometimes more harm than good can happen. Instead of instilling a mindset of perseverance, sacrifice or hard work, financial blessings can create entitlement or dependence without wisdom. At some point, you may have done “enough” financially for your family. This has to be a real consideration. You can still serve your family even if the answer for right now is ‘no.’ I have seen that entitlement and dependence are less likely to happen when we’re successful with passing on wisdom and values.

I have been blessed to have a wonderful mother and father. Not because our home was always perfect. Simply because I was taught important lessons about generosity, especially about finances. What are your children and grandchildren learning from you? Family goals are so valuable, yet can be approached in many ways. We’d love to hear about how you and your family creatively approach your family goals.

Join us next month for a conversation about our capital assets and investments and how they can shift the culture and influence the world for good.

Implementing Faithful Living with Intentionality

April 1, 2024by Ron Bare

It’s easy to talk the talk. But when it comes to walking the walk, that’s a little more difficult, isn’t it? We’ve all seen this in action. This is why it’s easy to say that we will be more mindful of our budget, but when we start to smell that coffee, the budget goes out the window. It’s why saying that we’re starting a diet is easy, but actually following through with the restrictions it brings is so difficult.

At Bare, we understand the importance of both talking about faithfulness and following through with it! We know it takes planning and intentionality to make this happen, and we want to equip you and your family with resources to be faithful.

But what does faithfulness mean? A simple google search shows ‘faithful’ to mean steadfast, or true to the facts. As we focus on our “Year of Faithfulness”, we’re praying that each staff member and client comes to understand faithfulness in a deeper manner and chooses to live that out personally. So far this year, we’ve defined faithfulness and shared some practical tips around faithful living. This month, we want to give you strategies to intentionally implement these principles.

These principles come from my learning over the last 30 years in financial advising combined with the study of God’s Word. His Word is steadfast and true; it is faithful!

I want to begin with the most important financial decision you get to make: deciding how much to give. I typically start by considering a 10% tithe. This is a biblical principle and I’ve found it to be a helpful starting point. From there, consider how you can be more generous each year. Set intentional generosity goals and work toward them. And remember, generosity is an overflow of the heart!

Second, consider defining ‘enough.’ Personally, I’ve set a budget that includes both necessary expenses and fun expenses, like traveling, eating out, and our family’s hobbies. This budget gives me an idea of just how much is enough. It protects against the danger of hoarding. Without this guardrail, we will all keep chasing more money, more traveling, more new cars, more, more, more.

Finally, I’d encourage you to set financial goals and invest with a specific personal goal in mind. This will help you determine how much to accumulate. Consider whether your investment decisions are in line with the personal goals you’ve set for yourself. What is needed to grow your business and make a bigger impact? Are you moving closer to or further from that? What are your retirement goals? What are your family goals? Consider your future goals and what decisions might need to be made now to make those things possible later.

Defining ‘enough’ for you and your family will be critical in this whole process. Once you are confident in having accumulated ‘enough’ to meet your financial goals, there are new things to consider! That stage of life is a beautiful time to increase your giving and invest capital in order to shift the culture and change the world for the glory of God. Stay tuned for next month’s blog as we will talk in more detail about this.

None of us can do this on our own. We each need people to walk alongside us as we make critical financial decisions and aim to glorify the Lord with what he has given to us.

Here at Bare, we’d love to walk with you on this journey. As we walk you through a holistic, biblical financial planning process, we will equip you with tools and resources to help guide your way. We’re here for the long haul.

If you’re interested in specific tools for living a God-honoring lifestyle, planning for kingdom giving, or saving and investing, reach out at barewealthadvisors.com. We’d love to connect with you and send these resources to you.

Living Faithfully – A Practical Guide

February 23, 2024by Ron Bare

Without a doubt, my favorite moment when flying on a plane is the descent. We’re finally about to land at our destination, whether it is a beautiful beach, a tropical island, or majestic mountains. And every time, I am in awe at the landscape below me. The way that the mountains, forests, oceans, and cities weave together captures all my attention. It’s stunning.

But I soon start to wonder. How do you get down there? Where does that path lead? Are there waterfalls in that forest that I can’t see from up here? What kind of wildlife lives in those mountains? These questions can only be answered on the path, in the forest, in the mountains, on the ground.

Today I want to take you with me to the ground. Last month, we were on the plane, looking at the idea of faithfulness from 10,000 feet in the air – what it means and what things hinder it. But simply talking about faithfulness can leave us lingering with questions about what it truly looks like on the ground, in real life.

As we consider faithfulness practically, we have six big thoughts and then a few practical tips that we believe are beneficial.

First, remember that God owns everything, and we are simply stewards. When we understand that everything we have belongs to the Lord, our heart is naturally drawn toward gratitude and faithfulness.

Second, work is important! God has given each of us resources to manage and they cannot be managed without discipline. Resources will not grow overnight; we must work to increase and invest in them.

Third, find contentment in the time, talent, and treasure God has given to you. Contentment is hard, that’s just the reality of it. Yet when we become content with our resources, how much easier it is to be faithful! We’re not constantly longing for more, promising that when we get just a little bit more, then we will choose to be faithful.

Similarly, be generous with this time, talent, and treasure! Generosity is the overflow of a content heart. When we understand that nothing we have is truly ours and are not longing for more, we will be generous.

Next, grow what God has given to you! In the parable of the talents, we see the master (Jesus) pleased with those servants who have increased what he originally gave them. While the master is gone, the servants are working hard to invest and even double what the master has given them to manage.

Finally, transfer stewardship to the next steward coming after you! Think of the generations to come after you – what can you teach them about stewardship? What have you learned in your lifetime both from successes and mistakes that can be passed on? Are you investing your wisdom into your kids, grandkids, neighbors, friends at church, or employees?

As we consider what faithfulness looks like, we’ve found two key practices that help get our minds and hearts in the right place.

Studying God’s Word and specifically the passages related to money is a great place to start. There are so many passages, and we’ll list a few of them at the bottom of this post!

Additionally, we’d encourage you to begin each day with this prayer – “God, all I have is yours. What would you have me do with the time, talents and treasure that you have placed in my hands?” As you pray this prayer, consider your impressions. Write them down, share them with your spouse or trusted friends, and engage with what God might have you do.

What have you discovered in your time on the ground? What is God asking you to do with what He has entrusted to you?

Fun fact – there are over 2,300 passages relating to money in the Bible! Here are just a few passages to consider when studying what God’s word says about faithfulness, stewardship, and money.

- I Timothy 6:17-19

- Psalm 24:1

- Jesus’ parables (about one third of them have to do with money)

- Matthew 13:44-46

- Matthew 25:14-30

- Luke 12:13-21

- Luke 18:10-14

- Luke 16:1-13

- 2 Corinthians chapters 8 and 9

- Malachi chapter 3

Focusing on Faithfulness in 2024

January 25, 2024by Ron Bare

I learned all about hard work growing up on a farm. I understood that the small,

unglamorous jobs had to be done. Yet this didn’t make my first job off the farm much easier. I

was working at a local lumber yard, and my job was to catch wood as it came through the

saw. Exciting, right? One day, my supervisor asked for someone to work outside to unload a

huge truck full of wood, and you better believe I was quick to volunteer! When I was done, no

one was around, so I went to find my supervisor to let him know. He was baffled. It was a

project he thought would take all day, and it had been done in just a few hours. He promoted

me on the spot, and I said goodbye to my lumber-catching role.

I was trusted with catching wood, and then I was trusted with unloading a truck, and

then I was trusted with even more responsibility. As I continued to prove faithful, I was

entrusted with more. And I believe this principle stands true spiritually as well. As Christians,

we are called to be faithful with what God has given us.

Jesus illustrates faithfulness in the parable of the talents – many of you have likely

heard this story found in Matthew 25. In this story, the master left town and entrusted his

possessions to three servants. Two servants invested what they had been given, making

double what they had received by the time the master returned. One servant buried what he

was given, fearful that he may lose it. The master was pleased with both servants who had

multiplied what they’d been given, and displeased with the other.

In this parable, we see the master, who represents Jesus, giving servants talents. After

he returns, he is pleased with those who have multiplied what he left them with. It all

belonged to him in the end; the servants were just stewarding what had been given to them.

Scriptures like Psalm 24:1 remind us of this very reality. All we have is God’s. And all of

these things we’ve been blessed with – finances, family, time, resources, etc. – we’re meant to

manage them in a way that honors Him.

What a tall task. And don’t overlook the fact that many temptations will arise,

encouraging you not to be faithful with your resources, and most of these dress themselves as

fear. We each have fears, especially when it comes to managing money. If I give some away,

will I have enough? What will others think of my financial decisions? Questions like these

will come from everywhere – culture, others, the enemy, and even from ourselves. We must

decide ahead of time that when we feel fearful, we will still choose to be faithful.

And when we choose to be faithful, we might also be led to ask what things God is

asking us to be faithful with. What does this really look like? First, God gives us time. How do

you spend your time? If you examine your time, what can it tell you about what you value?

Second, He gives us talents. What are you doing with the gifts and abilities God has given you?

Are you serving others with the specific giftings you have? Are you pointing back to God when

others praise you for these giftings? Third, He gives us treasure. How does your financial

management point to God?

When we are faithful with the little that He gives us, He entrusts us with more.

Faithfulness is not for the faint of heart. It demands that you recognize God as the

owner of everything you have. Once you acknowledge that, how much easier it is to be

faithful! God’s gifts to each of us in the form of time, talents, and treasure are unbelievable.

Let us thank Him for these gifts through our acts of faithfulness.

This year at Bare, we’ll be focusing on the year of faithfulness. As we provide

excellent wealth management grounded in Biblical wisdom, we have developed resources to

share with you that will help you identify and focus on key areas to grow in faithfulness. We

can’t wait to meet with you and talk about what faithfulness looks like.

Life on Purpose

July 3, 2023by Ron Bare

We all want the things we do to have purpose. As a kid, we want to have purpose in the sports we play – why do we play? How do we win? That kid turns into a teenager who wants to have purpose in their future – how do I get where I want to be? Do I need more schooling? That teenager turns into the adult who wants to have purpose in their family and their career – am I intentional with these things? How do I balance my marriage and work well?

These questions don’t end when you hit retirement. We know retirement brings big questions around how much is enough and how we might plan for it. But at Bare, we know that planning for retirement is more than just a financial conversation. We know that it’s also a consideration of what kind of purpose you want your later years to have and what kind of legacy you want to leave.

A study done in the U.S. found that the most productive stage in life is between the ages of 60-70. It found that the second most productive stage in life is between the ages of 70-801. This means that the typical American has the most productive, impactful years of their life in their retirement years!

While this may sound surprising, we know that retirees have more time to be generous with. Time spent in retirement can be so impactful. Whether you choose to volunteer with a local organization, spend time with your family, or share the wisdom you have gained with the next generation, your time can be an invaluable gift to those around you.

Luke 12 talks about this concept of managing our time and resources well. This passage, called the Parable of the Rich Fool, talks about a rich man who builds a large barn to store his crops in. He then chooses to “take life easy, eat, drink, and be merry” (NIV). Jesus condemns this choice. In fact, he says, “You fool! This very night your life will be demanded from you. Then who will get what you have prepared for yourself? This is how it will be with whoever stores up things for themselves but is not rich toward God” (NIV).

Jesus is reminding us here of the importance of being rich toward God – giving our energy, time, and resources toward the things that he cares about. If we can apply this lesson to our retirement years, we can be incredibly productive and impactful.

As you look toward retirement, ask yourself a few questions.

- What strengths do I have that I can use to serve others?

- How can I share my story in a way that impacts the next generation?

- How can I use my time, talent, and treasure in coordination with each other to make an impact on my community?

Bare Wealth Advisors walks alongside you as you process these questions and more. We craft a wealth management plan grounded in Biblical wisdom that is unique to you and your situation and the impact you want to make. In addition, 2023 is our “Year of Story”.” We’re helping you capture your story. What lessons have you learned? What things have shaped you? We’re interested in the lifelong perspective. We want to see our world impacted for the better and we know you have a lot to bring to the table through your story. Come talk with us – we’ll be there as you continue to seek wisdom while preparing for retirement!