Tag: investing

Planning for Uncertainty

April 24, 2025by Ron Bare

Early in my career I remember hearing that it is wise to plan for the “Certainty of Uncertainty”. As a financial advisor, this really resonated with me. Reflecting on that phrase now, after 30 years of experience, including various times of uncertainty, I firmly believe in the truth of that wisdom. When economic or market uncertainty is elevated, we believe in the importance of going back to values and principles to help you make wise financial decisions. And here at Bare Wealth Advisors, we believe the best values and principles to apply are those that are grounded in Biblical wisdom. Here are a few to consider during times of greater uncertainty:

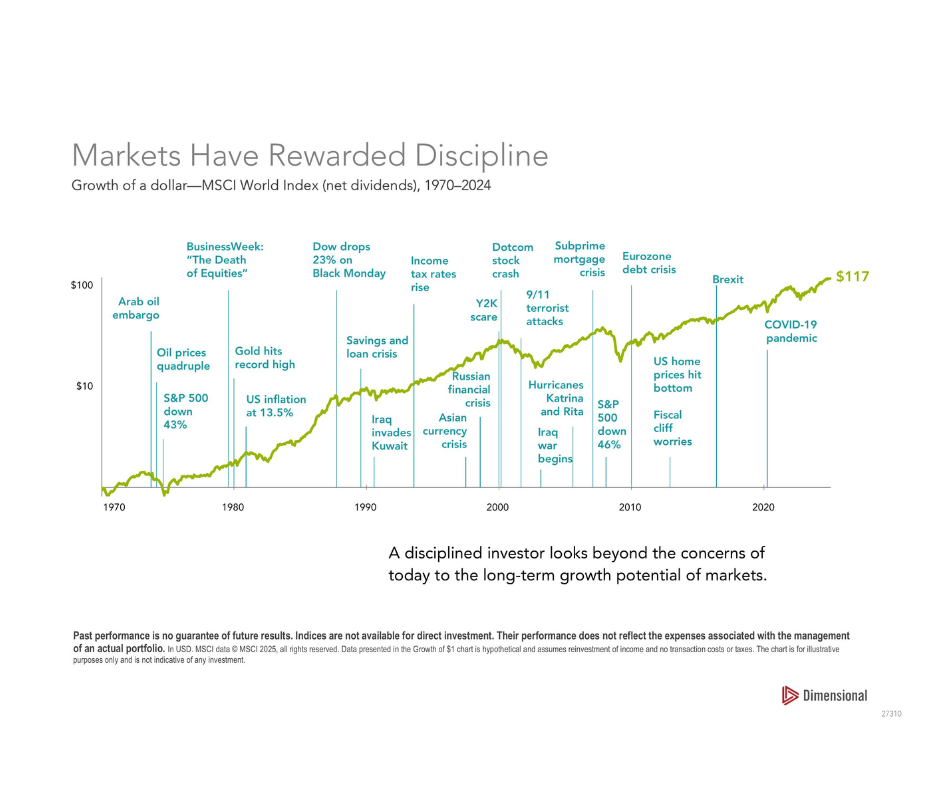

- Think Long-Term. A long-term perspective is very important to consider when thinking about investment decisions. The longer your perspective is, the better financial decisions you will typically make. Investing in the ownership of companies (which is what you do when you invest in the stock market) carries risks of economic and financial events. When you step back and look at the long term, investors are often rewarded for the risks taken. (Proverbs 13:11, 28:19-20)

- Diversify your investments. In our planning process we intentionally build our portfolios across various industries, sizes of companies and countries to help ensure diversification. We use various professional managers with many years of experience. In addition, we typically hold 5+ years of cash needs (or income) in more conservative investments that are not subject to as much market volatility in the short term. This allows investors to apply principle #1 – think long-term. (Ecclesiastes 11:1-2)

- Minimize debt. When a company or individual has minimal debt levels it reduces risks to their overall plan and future when uncertainty happens. (Proverbs 22:7, 26-27)

- Increase Generosity. We talk a lot about generosity at Bare. We believe being generous is one of the most important biblical principles to apply to our finances. Generosity takes a step of faith, it helps us to learn to trust God and be grateful. When we live with open hands and are generous to those in need, we are reminded of how blessed we are. Times of uncertainty are great times to consider how to be a blessing to others. (1 Timothy 6:17-19, 2 Cor. 9)

- Increase Margin. Financial margin can be vastly underrated. When you have margin in your monthly income and margin on your balance sheet it gives you a chance to take advantage of market volatility. Most people have heard the phrase “buy low – sell high,” but many are not prepared with margin to implement this when opportunity arises. (Proverbs 6:6-8). A good way to increase margin is to live within a budget to ensure that you have excess money to save and invest each month. Additionally, it is helpful to hold some cash in a reserve account for unexpected expenses as well as unexpected opportunities.

As always, we are here to talk to you about your personal financial and investment plans. We care about you and your family and remain committed to helping you steward your resources according to your God-given purpose; assisting you to make a significant difference in this world! I will leave you with a few quotes from two famous and successful investors:

Warren Buffet – “If you aren’t willing to own a stock for 10 years, don’t even think about owing it for 10 minutes”

John Templeton – the four most dangerous words for an investor “This time is different”

Staying the Course During Market Volatility

April 8, 2025by Ron Bare

Along with most Americans, we’ve been watching closely as President Donald Trump declared April 2nd to be “Liberation Day” and implemented broader tariffs than anticipated by economic watchdogs and television pundits. These tariffs, which include a 10% duty on all imports to the U.S. and meaningfully higher rates for some countries in particular, have had an immediate negative impact on the markets and led to concerns about a potential recession and increased market instability.

As always in times of such volatility, it’s natural to feel anxious about your investments. The rapid swings in stock prices can stir emotions, but it’s essential to remember that historically markets have demonstrated resilience over the long term, even in the face of policy-induced volatility.

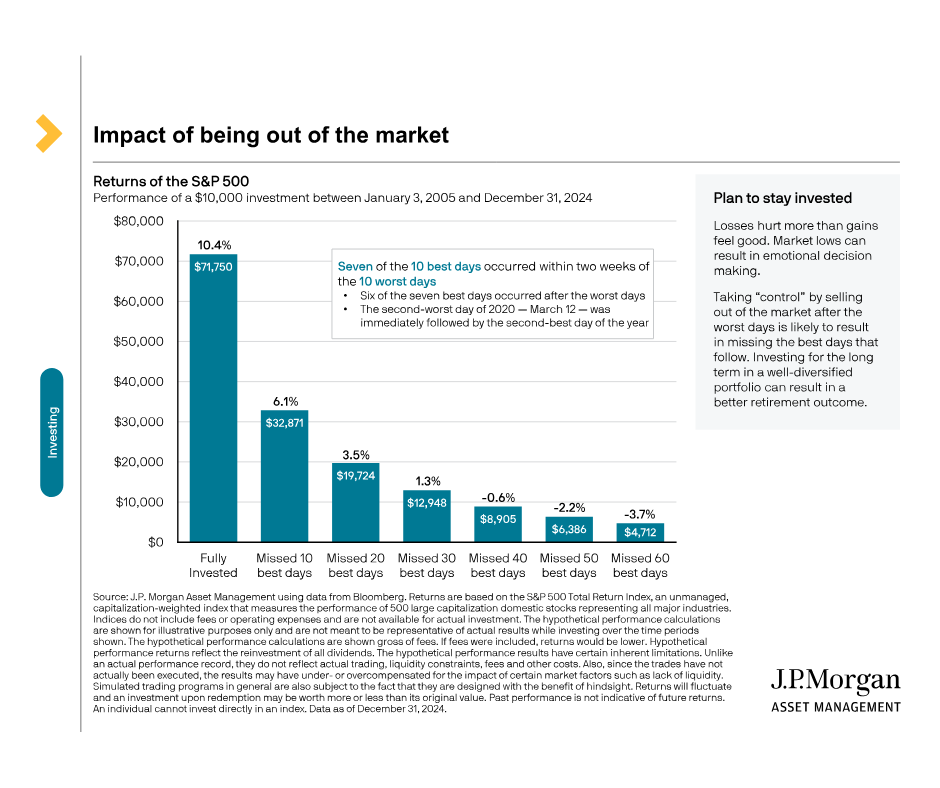

J.P. Morgan Asset Management’s oft-quoted research illustrates the importance of staying invested through turbulent periods. In one study, they analyzed the performance of a $10,000 investment in the S&P 500 between January 2004 and December 2023. If the investor stayed fully invested, the average annual return was 10.4%. However, missing just the 10 best days during that period cut the return to 6.1%. Missing the 20 best days dropped it further to 3.5% (see the data here). The impact of being out of the market for even a few key days—most of which tend to occur during periods of heightened volatility—can be dramatic.

“The stock market is a device for transferring money from the impatient to the patient” – Warren Buffett.

As the ‘Oracle of Omaha’ reminds us in the above quote, it’s important to keep in mind the psychological impact of market volatility. Behavioral finance studies suggest that the pain of losses often feels more intense than the pleasure of gains—a concept known as loss aversion. This can lead to panic selling, which often locks in losses and prevents investors from participating in subsequent market recoveries. Staying focused on your long-term goals and resisting the urge to make hasty decisions can help you avoid these pitfalls.

While this is the largest wave of American tariffs since President Hoover signed the Smoot-Hawley Tariff Act in 1930, it’s essential for us to maintain a long-term perspective. Reacting in fear or attempting to time the market during such periods can lead to missed opportunities and diminished returns. By staying the course and focusing on your long-term investment objectives, you position yourself to navigate through this volatility more effectively. Please see below for helpful graphic information on the value of staying the course.

As always, our team is here to support you in aligning your investment strategy with your financial goals, helping you navigate these uncertain times. Be on the lookout for additional communications and resources from our office in the coming days. In the meantime, we are available to talk if you’d like to reach out and discuss anything on your mind.

How Investing Can Help Change the World

July 22, 2024by Ron Bare

When did you decide you wanted to change the world? In 2009, at my first Kingdom Advisors conference, I realized for the first time that I was being called to be a “pastor of finance.” The Bible is full of so much truth about money – over 2,300 verses in fact! As I watched various people in my life apply these verses, I saw that each of these people had produced contentment, generosity, freedom, clarity, purpose, and ultimately faithfulness as a result of some of these practices. I knew that if I could use my passion to help others grasp a deeper understanding in this area, we could change the world together.

This was my story but ask others how to change the world and you’ll get answers all over the board. End world hunger, commit your life to cancer research, or live overseas as a missionary? These are all admirable. Yet, as I’ve grown and learned more about the financial world, I’ve learned that investing can have a huge impact on the world. So, why should we invest? What is this impact I’m talking about? I’m glad you asked.

Many would say that investing is a great way to grow wealth and that it provides a good rate of return – both of which can be true. These are two potential benefits to the investor. But what if I argued that investing really isn’t just about you, but that there can be a redemptive purpose for investing? Tim Macready, of Brightlight Capital, says it well. “Redemptive investing is moving unproductive capital to productive capital to make goods and services to promote human flourishing.”

Investing is not simply the act of setting money aside to someday see a return. Investing, at its core, is about supplying capital to businesses in exchange for ownership in the company and rights to profit and growth. Now this kind of investing will influence your community – if it is productive for human flourishing, because it impacts businesses and allows growth to happen. How does this apply as we look for companies to invest in?

Believing that we are stewards of God’s money forces us to consider what kinds of companies, properties, or businesses we choose to own or profit from. We are reminded of this higher responsibility in Luke 12:48; “When someone has been given much, much will be required in return; and when someone has been entrusted with much, even more will be required.” Are there then ‘good’ or ‘bad’ profits? Might a good profit be tied to a company that serves others ? And a bad profit be related to an investment that harms others?

As we each decide where, how, and when to invest, mistakes are normal. But we believe some of these mistakes are avoidable when the definition and purpose of investing are crystal clear.

One of the biggest mistakes we see is with those who do not have a purpose nor an end goal. Without purpose or clarity, accumulation is natural, but becomes hard to distinguish from hoarding. When we create parameters and know how much is enough, our investments are wise and purposeful.

Secondly, sometimes the primary purpose of investing becomes saving money on taxes. Saving money on taxes is a nice bonus, but leading with that motivation is not a great long-term plan. When focusing on solely saving taxes you may become stuck in frustrating long-term commitments or may not be able to meet your goals in the way that you could have otherwise.

Lastly, many non-liquid investments are highly leveraged . This certainly potentially increases the rate of return but also increases risk. If investing means supplying capital to fund a company we’re passionate about, yet we are obsessed with finding a high rate of return, we may take on unnecessary risk when investing in companies with high debt levels.

Investing doesn’t have to be complicated or stressful. It can be a beautiful picture of committing your resources to provide capital to companies that promote human flourishing and then enjoying the benefits of those companies’ successes.

- 1

- 1-3 of 3 results