Category: Investing

Is it Biblical to Bring Increase to Wealth?

July 31, 2025

by Ron Bare

The idea of increasing wealth can feel uncomfortable or even taboo in many Christian circles – often raising questions about intent, motive, and faith. While conversations about this topic can feel challenging, I invite you to join me in exploring a new perspective today, one that’s deeply rooted in Scripture.

In Matthew 25, Jesus tells a story of three servants entrusted with their master’s resources. The first two servants multiplied what was given to them, and the third servant buried his out of fear. The master praised the first two servants and condemned the third. The difference? Their stewardship of the wealth that was entrusted to them.

Throughout the Bible, we see an ongoing invitation to growth – in faith, love, generosity, influence, and sometimes in wealth. This is not about amassing wealth, but rather about faithful stewardship of the resources God has given to us. Like the third servant, we can become scared to pursue growth, fearing failure or loss. Yet we know that fear is not from God and it should not hold us back from pursuing growth.

Why is it important to consider growing, or increasing, our wealth? Ultimately, we know and trust that God is the owner of all that we have. When done with the right motive, seeking financial growth can be an act of worship as we continue to trust in Him for each of our needs. This principle is clear in Matthew 25 – the master entrusts bags of gold to the servants. The servants did not find the bags of gold on their own; they were given them. What they did with these bags of gold was a reflection of their relationship with their master.

Still, we know this topic can carry a stigma, and many churches shy away from teaching this. Why? The idea of growing wealth can appear similar to the prosperity gospel, the teaching that financial blessing will find you if you are faithful to God or have “enough” faith. The prosperity gospel misrepresents both God’s heart and our calling. Rather, our belief is that God has entrusted us each with specific blessings, and that someday, He will ask for an account of our stewardship. In light of this, we believe stewarding these resources well, including pursuing an increase, can be honoring to God.

But don’t forget the point – this isn’t about chasing wealth. In Psalm 24:1, we see that God is the owner of all things. In Psalm 8 and Genesis 1-2, we learn that though God has created everything, He has put us in charge of His creation. He has asked us to manage and grow the things He has made! If you are blessed to see an increase, what you do with that increase can be a beautiful reflection of your relationship with God. When we can combine this increase with a content heart, a generous spirit, and a purposeful plan, we can impact the Kingdom of God for good. This principle of bringing an increase to our wealth, and all that we have, is a thread that runs throughout Scripture. That’s why our impact statement here at Bare talks about how “intentional stewardship and extravagant generosity can change the world for the glory of God.” How can you change the world through stewardship and generosity? We encourage you to consider how pursuing growth might fit into your story, not for your sake, but for God’s glory.

Planning for Uncertainty

April 24, 2025by Ron Bare

Early in my career I remember hearing that it is wise to plan for the “Certainty of Uncertainty”. As a financial advisor, this really resonated with me. Reflecting on that phrase now, after 30 years of experience, including various times of uncertainty, I firmly believe in the truth of that wisdom. When economic or market uncertainty is elevated, we believe in the importance of going back to values and principles to help you make wise financial decisions. And here at Bare Wealth Advisors, we believe the best values and principles to apply are those that are grounded in Biblical wisdom. Here are a few to consider during times of greater uncertainty:

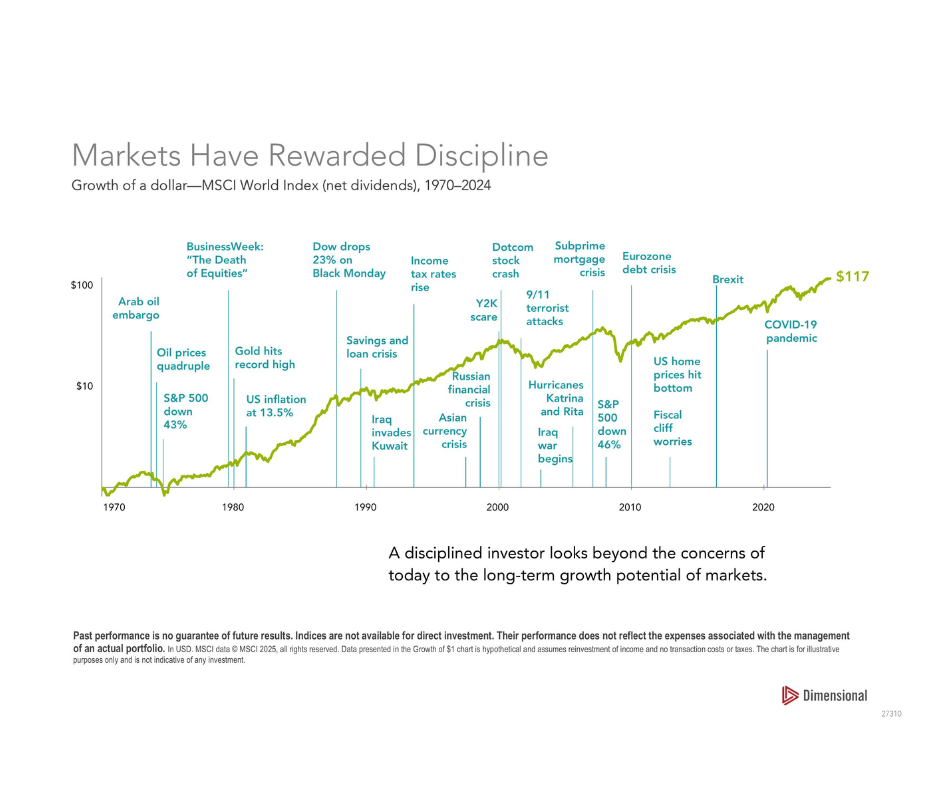

- Think Long-Term. A long-term perspective is very important to consider when thinking about investment decisions. The longer your perspective is, the better financial decisions you will typically make. Investing in the ownership of companies (which is what you do when you invest in the stock market) carries risks of economic and financial events. When you step back and look at the long term, investors are often rewarded for the risks taken. (Proverbs 13:11, 28:19-20)

- Diversify your investments. In our planning process we intentionally build our portfolios across various industries, sizes of companies and countries to help ensure diversification. We use various professional managers with many years of experience. In addition, we typically hold 5+ years of cash needs (or income) in more conservative investments that are not subject to as much market volatility in the short term. This allows investors to apply principle #1 – think long-term. (Ecclesiastes 11:1-2)

- Minimize debt. When a company or individual has minimal debt levels it reduces risks to their overall plan and future when uncertainty happens. (Proverbs 22:7, 26-27)

- Increase Generosity. We talk a lot about generosity at Bare. We believe being generous is one of the most important biblical principles to apply to our finances. Generosity takes a step of faith, it helps us to learn to trust God and be grateful. When we live with open hands and are generous to those in need, we are reminded of how blessed we are. Times of uncertainty are great times to consider how to be a blessing to others. (1 Timothy 6:17-19, 2 Cor. 9)

- Increase Margin. Financial margin can be vastly underrated. When you have margin in your monthly income and margin on your balance sheet it gives you a chance to take advantage of market volatility. Most people have heard the phrase “buy low – sell high,” but many are not prepared with margin to implement this when opportunity arises. (Proverbs 6:6-8). A good way to increase margin is to live within a budget to ensure that you have excess money to save and invest each month. Additionally, it is helpful to hold some cash in a reserve account for unexpected expenses as well as unexpected opportunities.

As always, we are here to talk to you about your personal financial and investment plans. We care about you and your family and remain committed to helping you steward your resources according to your God-given purpose; assisting you to make a significant difference in this world! I will leave you with a few quotes from two famous and successful investors:

Warren Buffet – “If you aren’t willing to own a stock for 10 years, don’t even think about owing it for 10 minutes”

John Templeton – the four most dangerous words for an investor “This time is different”

Staying the Course During Market Volatility

April 8, 2025by Ron Bare

Along with most Americans, we’ve been watching closely as President Donald Trump declared April 2nd to be “Liberation Day” and implemented broader tariffs than anticipated by economic watchdogs and television pundits. These tariffs, which include a 10% duty on all imports to the U.S. and meaningfully higher rates for some countries in particular, have had an immediate negative impact on the markets and led to concerns about a potential recession and increased market instability.

As always in times of such volatility, it’s natural to feel anxious about your investments. The rapid swings in stock prices can stir emotions, but it’s essential to remember that historically markets have demonstrated resilience over the long term, even in the face of policy-induced volatility.

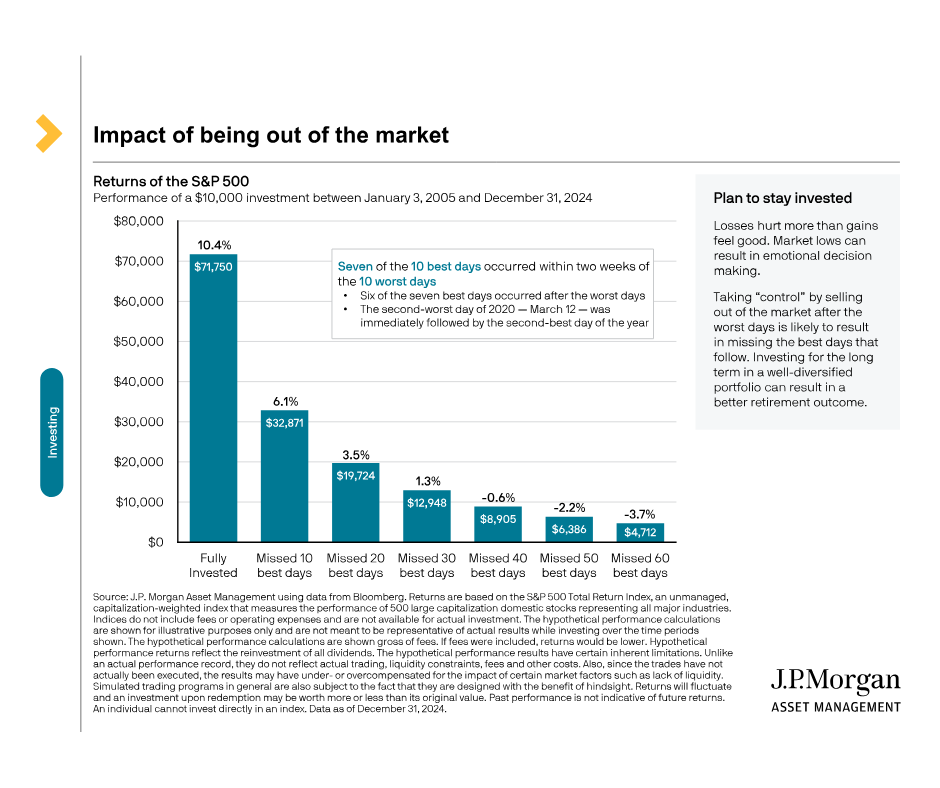

J.P. Morgan Asset Management’s oft-quoted research illustrates the importance of staying invested through turbulent periods. In one study, they analyzed the performance of a $10,000 investment in the S&P 500 between January 2004 and December 2023. If the investor stayed fully invested, the average annual return was 10.4%. However, missing just the 10 best days during that period cut the return to 6.1%. Missing the 20 best days dropped it further to 3.5% (see the data here). The impact of being out of the market for even a few key days—most of which tend to occur during periods of heightened volatility—can be dramatic.

“The stock market is a device for transferring money from the impatient to the patient” – Warren Buffett.

As the ‘Oracle of Omaha’ reminds us in the above quote, it’s important to keep in mind the psychological impact of market volatility. Behavioral finance studies suggest that the pain of losses often feels more intense than the pleasure of gains—a concept known as loss aversion. This can lead to panic selling, which often locks in losses and prevents investors from participating in subsequent market recoveries. Staying focused on your long-term goals and resisting the urge to make hasty decisions can help you avoid these pitfalls.

While this is the largest wave of American tariffs since President Hoover signed the Smoot-Hawley Tariff Act in 1930, it’s essential for us to maintain a long-term perspective. Reacting in fear or attempting to time the market during such periods can lead to missed opportunities and diminished returns. By staying the course and focusing on your long-term investment objectives, you position yourself to navigate through this volatility more effectively. Please see below for helpful graphic information on the value of staying the course.

As always, our team is here to support you in aligning your investment strategy with your financial goals, helping you navigate these uncertain times. Be on the lookout for additional communications and resources from our office in the coming days. In the meantime, we are available to talk if you’d like to reach out and discuss anything on your mind.

How Investing Can Help Change the World

July 22, 2024by Ron Bare

When did you decide you wanted to change the world? In 2009, at my first Kingdom Advisors conference, I realized for the first time that I was being called to be a “pastor of finance.” The Bible is full of so much truth about money – over 2,300 verses in fact! As I watched various people in my life apply these verses, I saw that each of these people had produced contentment, generosity, freedom, clarity, purpose, and ultimately faithfulness as a result of some of these practices. I knew that if I could use my passion to help others grasp a deeper understanding in this area, we could change the world together.

This was my story but ask others how to change the world and you’ll get answers all over the board. End world hunger, commit your life to cancer research, or live overseas as a missionary? These are all admirable. Yet, as I’ve grown and learned more about the financial world, I’ve learned that investing can have a huge impact on the world. So, why should we invest? What is this impact I’m talking about? I’m glad you asked.

Many would say that investing is a great way to grow wealth and that it provides a good rate of return – both of which can be true. These are two potential benefits to the investor. But what if I argued that investing really isn’t just about you, but that there can be a redemptive purpose for investing? Tim Macready, of Brightlight Capital, says it well. “Redemptive investing is moving unproductive capital to productive capital to make goods and services to promote human flourishing.”

Investing is not simply the act of setting money aside to someday see a return. Investing, at its core, is about supplying capital to businesses in exchange for ownership in the company and rights to profit and growth. Now this kind of investing will influence your community – if it is productive for human flourishing, because it impacts businesses and allows growth to happen. How does this apply as we look for companies to invest in?

Believing that we are stewards of God’s money forces us to consider what kinds of companies, properties, or businesses we choose to own or profit from. We are reminded of this higher responsibility in Luke 12:48; “When someone has been given much, much will be required in return; and when someone has been entrusted with much, even more will be required.” Are there then ‘good’ or ‘bad’ profits? Might a good profit be tied to a company that serves others ? And a bad profit be related to an investment that harms others?

As we each decide where, how, and when to invest, mistakes are normal. But we believe some of these mistakes are avoidable when the definition and purpose of investing are crystal clear.

One of the biggest mistakes we see is with those who do not have a purpose nor an end goal. Without purpose or clarity, accumulation is natural, but becomes hard to distinguish from hoarding. When we create parameters and know how much is enough, our investments are wise and purposeful.

Secondly, sometimes the primary purpose of investing becomes saving money on taxes. Saving money on taxes is a nice bonus, but leading with that motivation is not a great long-term plan. When focusing on solely saving taxes you may become stuck in frustrating long-term commitments or may not be able to meet your goals in the way that you could have otherwise.

Lastly, many non-liquid investments are highly leveraged . This certainly potentially increases the rate of return but also increases risk. If investing means supplying capital to fund a company we’re passionate about, yet we are obsessed with finding a high rate of return, we may take on unnecessary risk when investing in companies with high debt levels.

Investing doesn’t have to be complicated or stressful. It can be a beautiful picture of committing your resources to provide capital to companies that promote human flourishing and then enjoying the benefits of those companies’ successes.

A NEW Investment Perspective

November 10, 2023by Ron Bare

Beginning to see something with a new perspective changes everything. Many years ago, when you first saw your now-spouse as more than just a friend, it changed everything, didn’t it? When you began to see your job as a calling, it changed everything, didn’t it? And when you started to see your finances as a gift from the Lord and something to be stewarded for His glory, it changed everything, didn’t it?

We believe this same principle can be true with the stock market. If you can start to see the stock market in a new light, it just might change everything. What if instead of seeing your investment as tied to an obscure thing that we have named “the stock market,” you began to see your investment tied to real companies? And not just any companies, but some of the best in the world.

Do you think that would change things? I know it has for me.

All of a sudden instead of investing in an unpredictable, volatile stock market, you become a shareholder in some of the best businesses in the world. When you invest your assets into these companies, you become a part owner and share in their profit. You get to be a part of what each of these companies is doing and how they are impacting the world for the better.

We believe there are a few reasons that this mindset shift is critical.

First, it’s a whole lot easier to trust businesses than the stock market, right? Each business you invest in through the stock market has a business plan, financial advisors, CFO’s, CEO’s, Boards, and marketing professionals to help them be successful. They strive to make the best decision for themselves and their customers. If they start to lose money because of the decisions they’re making, they’ll change what they’re doing. And when these businesses do well, so does the stock market, because they are the stock market.

But what about when crises hit? You know it as well as I do – they’re inevitable. Yet as we look back through time through various crises – COVID, crises in the Middle East, or others, we see a trend in the market values of publicly traded companies. Not only do these companies survive, they often come out stronger on the other side of the crisis. And historically, if you stayed invested over a long period of time, your overall return from these companies far outpaces the rate of inflation.

Nick Murray, a well-known financial advisor, writes about the reality of this trend. Murray writes about the staggering difference between the increase in the dividend (profit distributions) of the S&P 500 (500 of the largest US companies) and the increase in inflation in the 50 years between 1972 and 2022. The dividend increased 21 times while inflation increased 7 times. In addition, The research indicates that dividend increases tend to outpace the rate of inflation. In addition, the pattern is that the increase in the stock market almost always has a positive correlation with earnings growth. (Murray).

Finally, a quick disclaimer. Many people spend a lot time trying to predict the short term direction of our economy and stock market. The truth is, nobody can promise you anything about what the economy or the stock market may do in the short term. When you invest in the stock market, there are risks involved. That’s just the reality of it. But as we follow the trends of history, we continually see the increases in the value of these companies far outpace inflation and we see the market value of these companies following earnings.

So why not reframe our perspective? Rather than thinking we’re investing in an unpredictable stock market, let’s change our mindset and understand that we are investing in some of the greatest companies in the world. Many of these companies are making a positive difference through the products and services they provide, and when you step into long-term investment with them, you get to be a part of something greater than yourself!

SOURCES

Murray, Nick. Nick Murray Interactive, vol. 23, no. 7, July 2023, pp. 1–2.

My Top 20 Investing Principles

October 2, 2023by Ron Bare

What could your future look like if you invested well? How could you bless your families, coworkers, or community? Over the years, I have gathered 20 principles that guide our investment strategy, and I’d love to share them with you!

- God is the owner and I am the steward. What do you own that God hasn’t blessed you with? He owns everything we have, which should encourage us to steward and invest it wisely and generously.

- Learn the secret of being content. Contentment drives away the continual need for more. See Phil. 4:12, Heb. 13:5

- Passing on wisdom is better than passing on wealth. Wealth doesn’t last. Wisdom does. Wisdom gets passed on and on, yet wealth vanishes with one decision or circumstance.

- Live generously. God blesses you so you can bless others. Plus, do you know any unhappy generous people? No? Me neither!

- Build margin into your time and money. Time margin allows you to serve, volunteer, and mentor. Financial margin allows you to invest, donate, and have enough when things go badly.

- Borrow cautiously and repay debts quickly. Repaying debts gives you financial freedom to invest, donate, or save for your kids and grandkids.

- Save 10-15% of your income. Saving helps you prepare for unexpected opportunities or crises. This is a practical way to build financial margin into your life!

- Own companies (mutual funds, ETF’s, and individual securities) and real estate. Once you’re an owner, hold these investments long-term.

- If it seems too good to be true, it is! If you’re skeptical or suspicious, seek wisdom from trusted advisors!

- Don’t blindly follow the crowd. Trends are temporary and will fade. The opposite of the crowd is often best!

- Don’t make financial decisions primarily to reduce taxes. Tax reduction is a great benefit. However, this shouldn’t be the driving force for financial decisions.

- Hold unwavering faith in the future. This is not for the faint of heart! Don’t become pessimistic in investing, rather trust companies will prosper and trends will continue upward in the long term.

- Diversify, diversify, diversify! Ecclesiastes 11 encourages us to invest in many different ventures, as we can not predict the future nor what will succeed.

- Invest within the context of your financial plan, goals, and values. Use your plan, goals, and values as a guide for where, when, and how much to invest.

- Be careful of the words “this time is different. ”The truth is, it’s probably not. Look for, study, and learn from patterns in the financial world!

- Build a trusted team of advisors. “Without counsel plans fail, but with many advisers they succeed,” says Proverbs 15:22. Who are your advisors? Where do you go for wisdom?

- Don’t waste time predicting what the markets will do in the short term. No one knows what they will do in the short term! Not you, not the professionals, not internet opinion articles, no one! Don’t waste your time.

- The best time to start investing is today! Don’t wait for the perfect time.

- Be careful with gold (perhaps 3-5% of your portfolio). Usually gold is sold out of fear of potential catastrophes in the world. Personally, the gold I buy is jewelry for my wife so we can enjoy it while we hold it!

- Never make an emotional financial decision. Emotions are good, but when it comes to finances, lean on wisdom, experiences, and your advisors.

These principles can’t promise a life of perfection and wealth. But they can promise to be a good starting point when learning to invest well. If you’re interested in talking more about investing, give us a call!

Nothing New Under the Sun

April 5, 2023by Ron Bare

Perhaps the most common mistake made when making investment decisions is making ANY investment decision outside the context of a written financial plan based on your goals and values. That is why Bare Wealth Advisors does not create investment portfolios for our clients without a plan.

Without a plan we are left to the news headlines and predictions from all the market “experts” – most of which are fear driven. Fear is a good salesperson, and financial journalism is guilty of “selling” the headline that will generate the most clicks. We believe wealth is ultimately a resource entrusted to us to maximize the impact and calling God has given us. We should never succumb to fear headlines and financial journalism’s goal of making short term investment decisions based on what the market may do over the next few months.

As Ecclesiastes tells us, “nothing is new under the sun.” Over the past year we have seen the following: war, inflation, rising interest rates, recession fears, supply chain constraints, and most recently the failure of Silicon Vally Bank (a tech focused bank which had heavy losses the past year). All this on top of coming out of a closed economy due to the Covid 19 pandemic, can be exhausting and emotional – however, none of these are “new under the sun!” We live in an uncertain world and one benefit of a financial plan is to help you plan for what we call the “certainty of uncertainty”.

Our advice is and always will be the same – think long term, diversify, minimize debt, live generously, live within your means, and create a tailored financial plan based on the individual values, purpose, and goals your family has established. However, in the meantime let me share a few thoughts regarding our current economic state.

There has been much discussion recently regarding the cause of the inflation we have been experiencing. Basic economics tell us that when you create too much of something the value of that something is reduced. The total M2 (money supply – or simply just think money in all bank accounts) increased by 40% during a two-year window of the pandemic. (Over $6 Trillion!) For perspective, the normal increase in M2 is about 6% per year. It does not take a rocket scientist to figure out this may reduce the value of money (the definition of inflation). The good news (of course nobody is focusing on any good news) is that M2 has decreased over the past 12 months and many leading indicators are showing that inflation is subsiding. It will take some time, but inflation is heading in the right direction – lower!

Remember, even though some indicators show inflation is declining, it is always challenging to predict what will happen in the “short-term.” More importantly, short term is not where we or you should focus. We are long term planners focused on the impact your resources can help you make over the next 10, 20 or 30 years!

As I wrap up these thoughts, I would like to encourage us all to make sure we receive the proper “inputs.” Begin with the NEVER changing word of God (Bible), understand the principles of truth and ask for wisdom to apply them to your life. Then surround yourself with advisors that know and care about you, listen to you and share your values, and can help you discern how to apply wisdom to the vision and impact God is calling you and your family to make – in this short life we have been privileged to live. Thank you for allowing us at Bare Wealth Advisors to be one of your trusted advisors, we are honored!

Intentional Contentment

August 11, 2022by Tina Petersheim

Cancelled plans. High school proms, college graduations, weddings, baby showers, birthday parties, anniversary celebrations, sporting events, vacations. The pandemic changed a lot of plans over the last couple of years as important milestones looked different. It would be easy to complain about all that was missed but what if we changed our focus and perspective for this “new normal”: A chance to be more intentional with the people in our lives, longer conversations with the people we love, meaningful encounters with those around us and time to disconnect from the chaos around us.

I met, dated, and married my husband in the middle of the pandemic. Like almost every girl, I imagined the princess dress, the extravagant cake, the lavish venue full of guests, the sendoff in a horse and carriage…. my very own fairytale wedding. Instead, I said “yes to the dress” online; our wedding list was shortened, our wedding cake was a few small desserts, the ballroom became the church lobby, and the grandeur exit was sitting around the table enjoying conversation with our kids.

As we focus on a year of intentionality at Bare, intentional contentment means choosing to be satisfied in all situations, experiencing joy and seeing God’s goodness, even when things don’t go as planned and life throws an unexpected curveball. After years of praying and experiencing loss, God had answered our prayers and my husband and I chose to find joy and contentment in the simpler things. We became intentional with the people we invited to our wedding as the room was filled with those who had weathered our journeys with us and with the ceremony as we shared how God merged the paths of two people who had lived through difficult circumstances.

The Apostle Paul learned the secret of being content and reminds us in Philippians 4:10b-11… “for I have learned how to be content with whatever I have. I know how to live on almost nothing or with everything. I have learned the secret of living in every situation, whether it is with a full stomach or empty, with plenty or little.”

How are you being intentional with being content in every circumstance? Are you choosing to be happy with the little things in life and live in the moment? Are you fully trusting in the One who has promised to meet every need? Maybe, like me, some things in your life don’t look quite like you thought they might. Maybe some of your goals have shifted or changed. At Bare, we help you through transitions to ensure your values, goals and purpose are directing your financial plan. Having a good financial plan that you feel confident about, along with regular “check-ins”, can help with living out the verses in Philippians and being content in every circumstance.

Ultimately, choose to recognize God’s blessings and enjoy the simpler things: long walks in the park, snuggles with a new baby, a cup of coffee on a rainy morning, relaxing on a sunny day. Know that God is in the details, canceled plans, and missed activities. After all, I still found my Prince Charming and am choosing to be intentional in living happily ever after.

Is This Time Different?

June 17, 2022The Equity (Stock) market by most gauges is now down well over 20% and has entered a bear market. We understand that times like this can be difficult as an investor, and we are here to help you make wise financial and investment decisions. Because we care about you and your financial plan, we want to provide you with some overall thoughts and perspectives on market volatility.

What is the cause of this bear market?

Inflation has surged, the federal reserve is raising interest rates (and reversing what is called QE or Quantitative Easing) and these actions are increasing the odds of a recession. Oil prices are at record highs (we all see this at the gas pump daily), and food prices are skyrocketing – not to mention the war in Ukraine. All these headlines and events may lead you to believe that “this time is different.”

Therein lies perhaps the most dangerous phrase of becoming a long-term successful investor. “This time is different.” If we believe this, then the next thought is, “I must pull my money out of the markets, or at least start preserving cash and stop investing my monthly amount into something that loses money each month.”

This time is NOT different. Recessions occur once every five years on average. While inflation is a problem right now, there have been times where it was much higher. Also, although the federal reserve is raising interest rates, they are still relatively low. Oil supply is still limited due to pandemic shutdowns (and other factors for another time) and demand has surged due to a full reopening of the economy. All of this will work its way out. In our opinion, more oil supply will come, demand will soften, inflation will cool, and the market will realize that the world is not ending. In time, this bear market will end.

This time is not different, if just FEELS different. It always does. In 2008 when banks were failing, housing was busting, and the market dropped over 50% (remember how that felt? I do!) – it certainly felt very different. However, those who stayed the course, added to their portfolios, and had faith in the future prevailed, and this time should be no different. During uncertain times it is good to reflect on time tested principles:

- Give more money away this year to a cause you care about (giving is a step of faith in a God who provides)

- Do not make financial decisions out of fear or worry.

- Think long term – we make better decisions when we think long term

- Add to your investment portfolio, assuming you have a few years until you need the money a drop in the market may be a good opportunity to invest with a long-term perspective.

- As we have talked about in the past, make decisions based on your holistic financial plan that is based on your goals, values, and timeframes – we are here to help review any of these details with you if that would be helpful.

Thank you for your continued partnership, and I wish to close with words from Paul in Philippians 4:6-7; “Do not be anxious about anything, but in every situation, by prayer and petition, with thanksgiving, present your requests to God. And the Peace of God, which transcends all understanding, will guard your heart and minds in Christ Jesus.”

Market Update May 2022

May 6, 2022by Ron Bare

With recent market volatility we know concerns can sometimes arise. We hope this video blog by Ron helps to alleviate any of your concerns and offers you peace of mind. As always, we are here should you like to speak directly with us. Please feel free to reach out to your advisor with any additional questions.