Category: Economy

Planning for Uncertainty

April 24, 2025by Ron Bare

Early in my career I remember hearing that it is wise to plan for the “Certainty of Uncertainty”. As a financial advisor, this really resonated with me. Reflecting on that phrase now, after 30 years of experience, including various times of uncertainty, I firmly believe in the truth of that wisdom. When economic or market uncertainty is elevated, we believe in the importance of going back to values and principles to help you make wise financial decisions. And here at Bare Wealth Advisors, we believe the best values and principles to apply are those that are grounded in Biblical wisdom. Here are a few to consider during times of greater uncertainty:

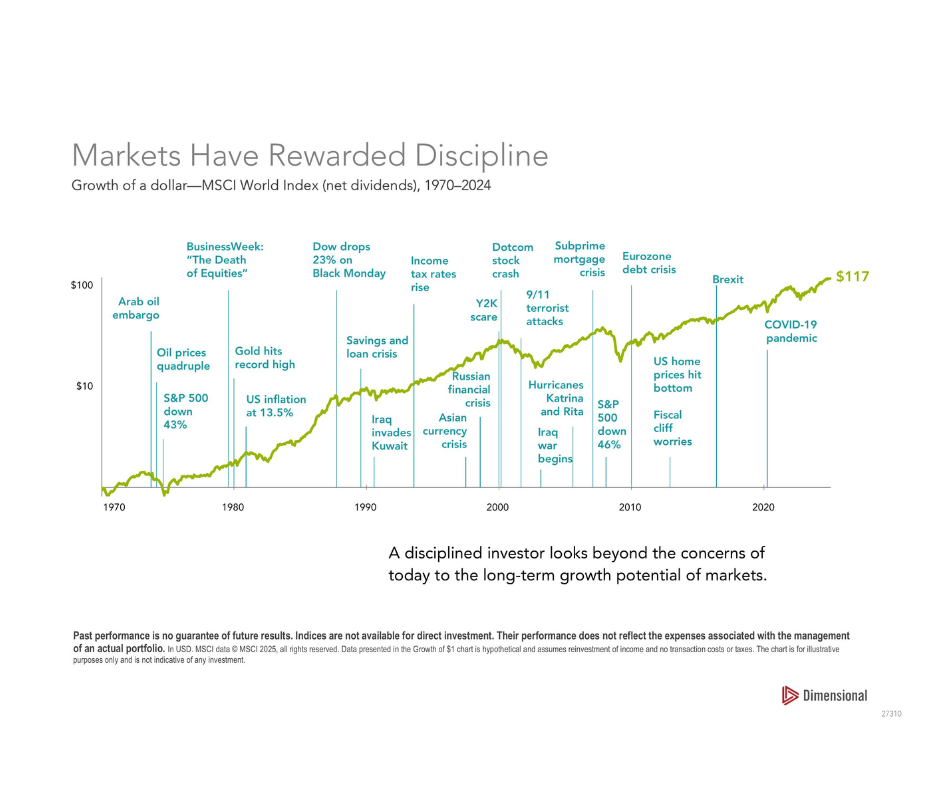

- Think Long-Term. A long-term perspective is very important to consider when thinking about investment decisions. The longer your perspective is, the better financial decisions you will typically make. Investing in the ownership of companies (which is what you do when you invest in the stock market) carries risks of economic and financial events. When you step back and look at the long term, investors are often rewarded for the risks taken. (Proverbs 13:11, 28:19-20)

- Diversify your investments. In our planning process we intentionally build our portfolios across various industries, sizes of companies and countries to help ensure diversification. We use various professional managers with many years of experience. In addition, we typically hold 5+ years of cash needs (or income) in more conservative investments that are not subject to as much market volatility in the short term. This allows investors to apply principle #1 – think long-term. (Ecclesiastes 11:1-2)

- Minimize debt. When a company or individual has minimal debt levels it reduces risks to their overall plan and future when uncertainty happens. (Proverbs 22:7, 26-27)

- Increase Generosity. We talk a lot about generosity at Bare. We believe being generous is one of the most important biblical principles to apply to our finances. Generosity takes a step of faith, it helps us to learn to trust God and be grateful. When we live with open hands and are generous to those in need, we are reminded of how blessed we are. Times of uncertainty are great times to consider how to be a blessing to others. (1 Timothy 6:17-19, 2 Cor. 9)

- Increase Margin. Financial margin can be vastly underrated. When you have margin in your monthly income and margin on your balance sheet it gives you a chance to take advantage of market volatility. Most people have heard the phrase “buy low – sell high,” but many are not prepared with margin to implement this when opportunity arises. (Proverbs 6:6-8). A good way to increase margin is to live within a budget to ensure that you have excess money to save and invest each month. Additionally, it is helpful to hold some cash in a reserve account for unexpected expenses as well as unexpected opportunities.

As always, we are here to talk to you about your personal financial and investment plans. We care about you and your family and remain committed to helping you steward your resources according to your God-given purpose; assisting you to make a significant difference in this world! I will leave you with a few quotes from two famous and successful investors:

Warren Buffet – “If you aren’t willing to own a stock for 10 years, don’t even think about owing it for 10 minutes”

John Templeton – the four most dangerous words for an investor “This time is different”

Staying the Course During Market Volatility

April 8, 2025by Ron Bare

Along with most Americans, we’ve been watching closely as President Donald Trump declared April 2nd to be “Liberation Day” and implemented broader tariffs than anticipated by economic watchdogs and television pundits. These tariffs, which include a 10% duty on all imports to the U.S. and meaningfully higher rates for some countries in particular, have had an immediate negative impact on the markets and led to concerns about a potential recession and increased market instability.

As always in times of such volatility, it’s natural to feel anxious about your investments. The rapid swings in stock prices can stir emotions, but it’s essential to remember that historically markets have demonstrated resilience over the long term, even in the face of policy-induced volatility.

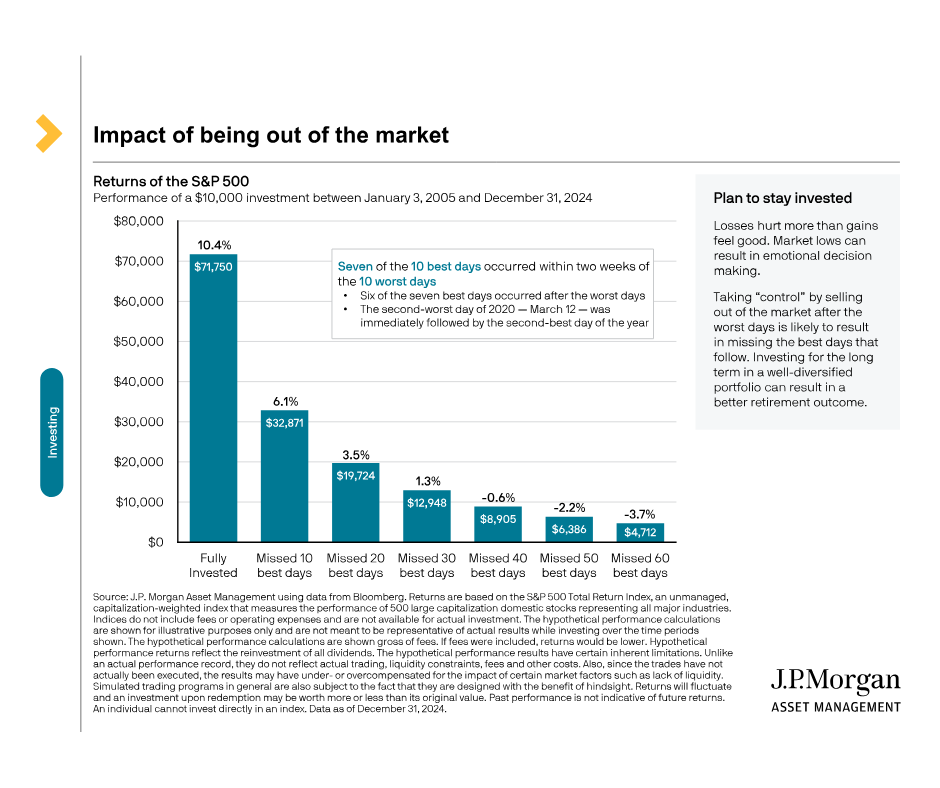

J.P. Morgan Asset Management’s oft-quoted research illustrates the importance of staying invested through turbulent periods. In one study, they analyzed the performance of a $10,000 investment in the S&P 500 between January 2004 and December 2023. If the investor stayed fully invested, the average annual return was 10.4%. However, missing just the 10 best days during that period cut the return to 6.1%. Missing the 20 best days dropped it further to 3.5% (see the data here). The impact of being out of the market for even a few key days—most of which tend to occur during periods of heightened volatility—can be dramatic.

“The stock market is a device for transferring money from the impatient to the patient” – Warren Buffett.

As the ‘Oracle of Omaha’ reminds us in the above quote, it’s important to keep in mind the psychological impact of market volatility. Behavioral finance studies suggest that the pain of losses often feels more intense than the pleasure of gains—a concept known as loss aversion. This can lead to panic selling, which often locks in losses and prevents investors from participating in subsequent market recoveries. Staying focused on your long-term goals and resisting the urge to make hasty decisions can help you avoid these pitfalls.

While this is the largest wave of American tariffs since President Hoover signed the Smoot-Hawley Tariff Act in 1930, it’s essential for us to maintain a long-term perspective. Reacting in fear or attempting to time the market during such periods can lead to missed opportunities and diminished returns. By staying the course and focusing on your long-term investment objectives, you position yourself to navigate through this volatility more effectively. Please see below for helpful graphic information on the value of staying the course.

As always, our team is here to support you in aligning your investment strategy with your financial goals, helping you navigate these uncertain times. Be on the lookout for additional communications and resources from our office in the coming days. In the meantime, we are available to talk if you’d like to reach out and discuss anything on your mind.

Biblical Wisdom for Uncertain Times

September 23, 2024By Ron Bare

Uncertainty is a certainty in this world, and if you don’t believe me, turn on the news. This year alone has been filled with plenty of uncertainty – an assassination attempt, war in the Middle East, war in Ukraine, an election, and I could go on.

Uncertainty is inevitable and unpredictable, so how can we prepare for it? What is a biblical understanding of uncertainty? I believe that the Bible provides valuable guidance on this topic. Several biblical principles have guided me in my thinking about uncertainty.

First, in Matthew 7, we read about the wise man who built his house on solid ground to protect against rain and storms. He didn’t know when the rain and storms would come or what they would be like, but he knew they would certainly come, and he prepared for them.

Part of building on solid ground involves significant planning. Luke 14:28 reminds us of the importance of planning our finances. Here at Bare, we listen to your story, values, and goals and then create a personal financial plan for each client. Why? We know that each situation is different, and we want to do our best to set each client up for success in both the good and the challenging times.

Plan as we may, we know disaster still strikes. Ecclesiastes 11:1-2 reminds us of this: “…you do not know what disaster will come.” Notice that it doesn’t say, “you do not know if disaster will come.” Between cash, real estate, equities, and businesses, plans will go awry. Wisdom reminds us that things will be difficult.

In light of difficult times, I’m grateful for a passage in 2 Corinthians that shares a real-life story of generosity in uncertain times. The Macedonians experienced severe poverty, but continued to give generously. 2 Cor 8:2-3 reads, “In the midst of a very severe trial, their overflowing joy and their extreme poverty welled up in rich generosity. For I testify that they gave as much as they were able, and even beyond their ability.” How incredible would it be to follow in that testimony even in times of uncertainty or poverty?

Uncertainty and difficult times can be stressful and disheartening. But what if through it all we could think long-term and stay optimistic? I know, it is not an easy ask. It’s much easier to let the weight of uncertainty cloud our vision. Suddenly, short-term investments or other shortcuts seem like a good option, and we hear messages like “this time is different.” Don’t be fooled; don’t let uncertainty cloud your vision. Continue to hold to your financial plan, seek wisdom from the Bible, and remember “there is nothing new under the sun.” Eccl. 1:9. Staying the course in this area will pay off.

Fear can accompany these feelings of stress, but the parable of the talents in Matthew 25 has spoken to this and helped to ground me. Jesus begs us to remember that we are not the owner of our resources, but rather a steward tasked with working and investing to grow what has been entrusted to us.

As stewards, God has not given us the ability to know the future, and I am honestly glad He has not. We must rely on Him for the future, trusting the teachings that He has graciously revealed to us that guide us toward faithful stewardship. Let us build our lives on solid ground and trust the future to His hands.

At Bare, we encourage you to think in a way that we describe as “beyond abundance.” This is a posture of confidence in God acknowledging that He can richly provide for us beyond what we need so that we can generously share with others. A “beyond abundance” way of living offers freedom and opportunities to live a life of fullness; to impact the world far beyond what we could hope or imagine.

When I experience the uncertainty of our world, I am filled with gratitude for God, who has given us biblical teachings to guide us in the midst of it all. Consider how it might impact your life if you built your life on solid ground, planned your finances with wise counsel, diversified, gave generously, stayed optimistic, and remembered who the true owner is. Let’s live beyond abundance together!

A NEW Investment Perspective

November 10, 2023by Ron Bare

Beginning to see something with a new perspective changes everything. Many years ago, when you first saw your now-spouse as more than just a friend, it changed everything, didn’t it? When you began to see your job as a calling, it changed everything, didn’t it? And when you started to see your finances as a gift from the Lord and something to be stewarded for His glory, it changed everything, didn’t it?

We believe this same principle can be true with the stock market. If you can start to see the stock market in a new light, it just might change everything. What if instead of seeing your investment as tied to an obscure thing that we have named “the stock market,” you began to see your investment tied to real companies? And not just any companies, but some of the best in the world.

Do you think that would change things? I know it has for me.

All of a sudden instead of investing in an unpredictable, volatile stock market, you become a shareholder in some of the best businesses in the world. When you invest your assets into these companies, you become a part owner and share in their profit. You get to be a part of what each of these companies is doing and how they are impacting the world for the better.

We believe there are a few reasons that this mindset shift is critical.

First, it’s a whole lot easier to trust businesses than the stock market, right? Each business you invest in through the stock market has a business plan, financial advisors, CFO’s, CEO’s, Boards, and marketing professionals to help them be successful. They strive to make the best decision for themselves and their customers. If they start to lose money because of the decisions they’re making, they’ll change what they’re doing. And when these businesses do well, so does the stock market, because they are the stock market.

But what about when crises hit? You know it as well as I do – they’re inevitable. Yet as we look back through time through various crises – COVID, crises in the Middle East, or others, we see a trend in the market values of publicly traded companies. Not only do these companies survive, they often come out stronger on the other side of the crisis. And historically, if you stayed invested over a long period of time, your overall return from these companies far outpaces the rate of inflation.

Nick Murray, a well-known financial advisor, writes about the reality of this trend. Murray writes about the staggering difference between the increase in the dividend (profit distributions) of the S&P 500 (500 of the largest US companies) and the increase in inflation in the 50 years between 1972 and 2022. The dividend increased 21 times while inflation increased 7 times. In addition, The research indicates that dividend increases tend to outpace the rate of inflation. In addition, the pattern is that the increase in the stock market almost always has a positive correlation with earnings growth. (Murray).

Finally, a quick disclaimer. Many people spend a lot time trying to predict the short term direction of our economy and stock market. The truth is, nobody can promise you anything about what the economy or the stock market may do in the short term. When you invest in the stock market, there are risks involved. That’s just the reality of it. But as we follow the trends of history, we continually see the increases in the value of these companies far outpace inflation and we see the market value of these companies following earnings.

So why not reframe our perspective? Rather than thinking we’re investing in an unpredictable stock market, let’s change our mindset and understand that we are investing in some of the greatest companies in the world. Many of these companies are making a positive difference through the products and services they provide, and when you step into long-term investment with them, you get to be a part of something greater than yourself!

SOURCES

Murray, Nick. Nick Murray Interactive, vol. 23, no. 7, July 2023, pp. 1–2.

Nothing New Under the Sun

April 5, 2023by Ron Bare

Perhaps the most common mistake made when making investment decisions is making ANY investment decision outside the context of a written financial plan based on your goals and values. That is why Bare Wealth Advisors does not create investment portfolios for our clients without a plan.

Without a plan we are left to the news headlines and predictions from all the market “experts” – most of which are fear driven. Fear is a good salesperson, and financial journalism is guilty of “selling” the headline that will generate the most clicks. We believe wealth is ultimately a resource entrusted to us to maximize the impact and calling God has given us. We should never succumb to fear headlines and financial journalism’s goal of making short term investment decisions based on what the market may do over the next few months.

As Ecclesiastes tells us, “nothing is new under the sun.” Over the past year we have seen the following: war, inflation, rising interest rates, recession fears, supply chain constraints, and most recently the failure of Silicon Vally Bank (a tech focused bank which had heavy losses the past year). All this on top of coming out of a closed economy due to the Covid 19 pandemic, can be exhausting and emotional – however, none of these are “new under the sun!” We live in an uncertain world and one benefit of a financial plan is to help you plan for what we call the “certainty of uncertainty”.

Our advice is and always will be the same – think long term, diversify, minimize debt, live generously, live within your means, and create a tailored financial plan based on the individual values, purpose, and goals your family has established. However, in the meantime let me share a few thoughts regarding our current economic state.

There has been much discussion recently regarding the cause of the inflation we have been experiencing. Basic economics tell us that when you create too much of something the value of that something is reduced. The total M2 (money supply – or simply just think money in all bank accounts) increased by 40% during a two-year window of the pandemic. (Over $6 Trillion!) For perspective, the normal increase in M2 is about 6% per year. It does not take a rocket scientist to figure out this may reduce the value of money (the definition of inflation). The good news (of course nobody is focusing on any good news) is that M2 has decreased over the past 12 months and many leading indicators are showing that inflation is subsiding. It will take some time, but inflation is heading in the right direction – lower!

Remember, even though some indicators show inflation is declining, it is always challenging to predict what will happen in the “short-term.” More importantly, short term is not where we or you should focus. We are long term planners focused on the impact your resources can help you make over the next 10, 20 or 30 years!

As I wrap up these thoughts, I would like to encourage us all to make sure we receive the proper “inputs.” Begin with the NEVER changing word of God (Bible), understand the principles of truth and ask for wisdom to apply them to your life. Then surround yourself with advisors that know and care about you, listen to you and share your values, and can help you discern how to apply wisdom to the vision and impact God is calling you and your family to make – in this short life we have been privileged to live. Thank you for allowing us at Bare Wealth Advisors to be one of your trusted advisors, we are honored!

Is This Time Different?

June 17, 2022The Equity (Stock) market by most gauges is now down well over 20% and has entered a bear market. We understand that times like this can be difficult as an investor, and we are here to help you make wise financial and investment decisions. Because we care about you and your financial plan, we want to provide you with some overall thoughts and perspectives on market volatility.

What is the cause of this bear market?

Inflation has surged, the federal reserve is raising interest rates (and reversing what is called QE or Quantitative Easing) and these actions are increasing the odds of a recession. Oil prices are at record highs (we all see this at the gas pump daily), and food prices are skyrocketing – not to mention the war in Ukraine. All these headlines and events may lead you to believe that “this time is different.”

Therein lies perhaps the most dangerous phrase of becoming a long-term successful investor. “This time is different.” If we believe this, then the next thought is, “I must pull my money out of the markets, or at least start preserving cash and stop investing my monthly amount into something that loses money each month.”

This time is NOT different. Recessions occur once every five years on average. While inflation is a problem right now, there have been times where it was much higher. Also, although the federal reserve is raising interest rates, they are still relatively low. Oil supply is still limited due to pandemic shutdowns (and other factors for another time) and demand has surged due to a full reopening of the economy. All of this will work its way out. In our opinion, more oil supply will come, demand will soften, inflation will cool, and the market will realize that the world is not ending. In time, this bear market will end.

This time is not different, if just FEELS different. It always does. In 2008 when banks were failing, housing was busting, and the market dropped over 50% (remember how that felt? I do!) – it certainly felt very different. However, those who stayed the course, added to their portfolios, and had faith in the future prevailed, and this time should be no different. During uncertain times it is good to reflect on time tested principles:

- Give more money away this year to a cause you care about (giving is a step of faith in a God who provides)

- Do not make financial decisions out of fear or worry.

- Think long term – we make better decisions when we think long term

- Add to your investment portfolio, assuming you have a few years until you need the money a drop in the market may be a good opportunity to invest with a long-term perspective.

- As we have talked about in the past, make decisions based on your holistic financial plan that is based on your goals, values, and timeframes – we are here to help review any of these details with you if that would be helpful.

Thank you for your continued partnership, and I wish to close with words from Paul in Philippians 4:6-7; “Do not be anxious about anything, but in every situation, by prayer and petition, with thanksgiving, present your requests to God. And the Peace of God, which transcends all understanding, will guard your heart and minds in Christ Jesus.”

Market Update May 2022

May 6, 2022by Ron Bare

With recent market volatility we know concerns can sometimes arise. We hope this video blog by Ron helps to alleviate any of your concerns and offers you peace of mind. As always, we are here should you like to speak directly with us. Please feel free to reach out to your advisor with any additional questions.

Thoughts on the crisis in Ukraine

March 9, 2022by Ron Bare

Like you, all of us at Bare Wealth Advisors are concerned about the recent world events, most significantly the Russian invasion into Ukraine. In the days ahead, please contact your team here at Bare Wealth Advisors if you have specific questions on how this affects your personal financial plan. In the meantime, I feel compelled to share some overall thoughts and words of encouragement.

- There will be plenty of blame to go around for this event in the days and months ahead – for now, I suggest praying for peace and protection for the nation of Ukraine.

- We are seeing extreme price movement in food and energy, which is likely to continue. Keep in mind, the US was energy independent within the last couple years. I believe our country has the capability to produce the energy we will need in the long-term. Since Ukraine is a large producer of wheat, we will continue to see increases in our food costs until this uncertainty is behind us.

- In my opinion, Russia desires control and money from both energy and agriculture (mostly energy) and that is what this war is about. In my opinion, Putin does not want to start World War 3.

- Financial Steps to take:

- Live within your means – spend less than you earn

- Give generously to those in need – here is a link to 20 organizations that are helping people in Ukraine: https://www.ncfgiving.com/stories/help-for-ukraine-10-charities-on-the-frontlines/

- Minimize debt

- Think long term – this too will pass. Continue to “work” the financial plan we have put in place. If you are adding to investment accounts, please continue to invest and possibly increase the amount of money you are investing. You are investing into some great companies that over the long term may reward you with good profits. If you have excess cash (margin) in your financial plan this may be a great time to consider buying some of these companies shares.

- Do not fear: Read Matthew 6: 19-34 (read verses 25-27 below)

- V25: That is why I tell you not to worry about everyday life – whether you have enough food or drink, or enough clothes to wear. Isn’t your life more than food, and your body more than clothing? V26: Look at the birds. They don’t plant or harvest or store food in barns, for your heavenly father feeds them. And aren’t you far more valuable to him than they are? V27: Can all your worries add a single moment to your life?”

Thank you for trusting in our team. We are here to serve you and we would be happy to help bring clarity to any questions you have concerning your personal financial plan.

Sincerely,

Ron Bare and the entire Bare Wealth Team

Market Thoughts 101

February 7, 2022By Ryan Kurtz

It is January 26th, 2022, as I sit down to write my thoughts on the current state of the stock market. After 3 great years in the market (measured by the S&P 500 Index) in which a $100,000 investment would have grown to almost $180,000, the market is down 8.5% since January 1st. Does that mean the stock market is no longer a good place to invest? Let’s take a deeper look.

What creates volatility in the stock market?

The “market” is just an auction that happens every business day in which investors (owners) in companies buy and sell their ownership shares. If there are more buyers bidding, then there are sellers selling of a company, the shares go up in price. If there are more sellers than buyers, the share price goes down. There are many things that would make people want to buy or sell – a CEO retiring, a new product that investors think is a good idea, profits in a quarter are better than expected, and on and on.

Are we going to see a decline or drop in the market? The answer is yes. When, and how much, I have no idea (and no one else does either, it is just speculation.) Just because the market drops does not mean it is a bad place to invest. It is the nature of this type of investment that is priced by a daily auction. No one knows the future and even when very intelligent people predict what “may” happen to the market, they are often wrong.

Is the stock market still a good place to invest? The answer is – it depends. It depends on what you plan to use the money you invest into the market for. It is typically a good place to invest for someone that has a long-term plan to own the investment. If you need the money you’re investing in 1 – 3 years, it may not be a good place to invest. For investors that have been able to hold investments in the stock market for 10 years or more they would have had an investment that would have provided a good average annual return during most decades. If you only would be able to hold the investment for a year or two, you would have had a 25% – 30% chance of losing money*.

So, what are our current thoughts on the Market?

- The market is a good place to invest for a long-term investor

- The market could be too much risk to take if you are a short-term investor

- Based on our experience and working with many families; the stock market is one of the 3 best investments one should own to create wealth. The other two are real estate and private business.

In closing, our encouragement to our clients is to keep a long-term focus regarding your investment portfolio and understand how these investments fit into your overall financial plan. If you have a good understanding of the investments purpose, timeframe, and needs for you and your family you are much more likely to be a successful long-term investor!

*American Funds, The ICA Guide 2021 edition: Class A shares; MFS Investment Management, Principles of Long Term Investing Resilience

Larry Burkett – A Life of Impact

September 27, 2021by Ryan Kurtz

As many of you know, our theme at Bare Wealth Advisors for 2021 is “Impact.” Specifically, we are challenging our staff and clients to ask, “how can we use our resources and lives to have an impact on others?”

As I reflect on my life and career, a man comes to mind that was very influential in my own life as well as extremely influential in our industry. Even though he is no longer with us on earth, Larry Burkett epitomizes a life of impact.

As I reflect on my life and career, a man comes to mind that was very influential in my own life as well as extremely influential in our industry. Even though he is no longer with us on earth, Larry Burkett epitomizes a life of impact.

Larry passed away when I was 25 years old, and I was never able to meet him. My remembrance of Larry Burkett was when I spent afternoons as a young boy feeding animals and milking cows in the barn on our family farm. Typical of many farmers, the radio was playing, and every midafternoon a show called “Money Matters” aired. It was a “call-in” type of show where people would ask Larry financial questions and he would answer them. I was always struck by the way Larry gave answers to callers with knowledge for each financial situation while simultaneously integrating Biblical wisdom with the answer. His words were full of love for each person regardless of the financial situation – even if the caller found themselves in very negative appearing circumstances. Years later, as I began my career in the financial field as an advisor, part of my desire to help others came from wanting to “be like Larry” – to give loving financial advice integrated with God’s Word.

In addition to the radio show, Larry published over 70 books in his lifetime, and sales of these books now exceed 11 million copies. As I prepare for meetings with clients, I still have many of his books in my office that I pull out from time to time to see what Larry said about a certain topic. It is interesting to me that when I look up the advice he gave in his writings there is almost always a Bible reference included.

Not only did Larry impact me personally (and many others) through his radio broadcasts and writings, Larry was also instrumental in starting or helping to start a number of wonderful Christian financial ministries. At Bare Wealth Advisors we still are closely connected to several of these ministries, and they continue to impact so much of what we do each day. Some of these organizations that we use and connect with regularly are Kingdom Advisors, National Christian Foundation, Crown Financial Ministries, and the Money Wise radio show.

As I reflect on the impact that Larry’s life had on me and many others, I ask myself, “on who am I having an impact?” “Am I having the same life changing impact on others as Larry’s life impacted mine?” I will always be forever grateful for Larry’s life and the way God used him to influence me in so many areas of my life.