Tag: volatility

Staying the Course During Market Volatility

April 8, 2025by Ron Bare

Along with most Americans, we’ve been watching closely as President Donald Trump declared April 2nd to be “Liberation Day” and implemented broader tariffs than anticipated by economic watchdogs and television pundits. These tariffs, which include a 10% duty on all imports to the U.S. and meaningfully higher rates for some countries in particular, have had an immediate negative impact on the markets and led to concerns about a potential recession and increased market instability.

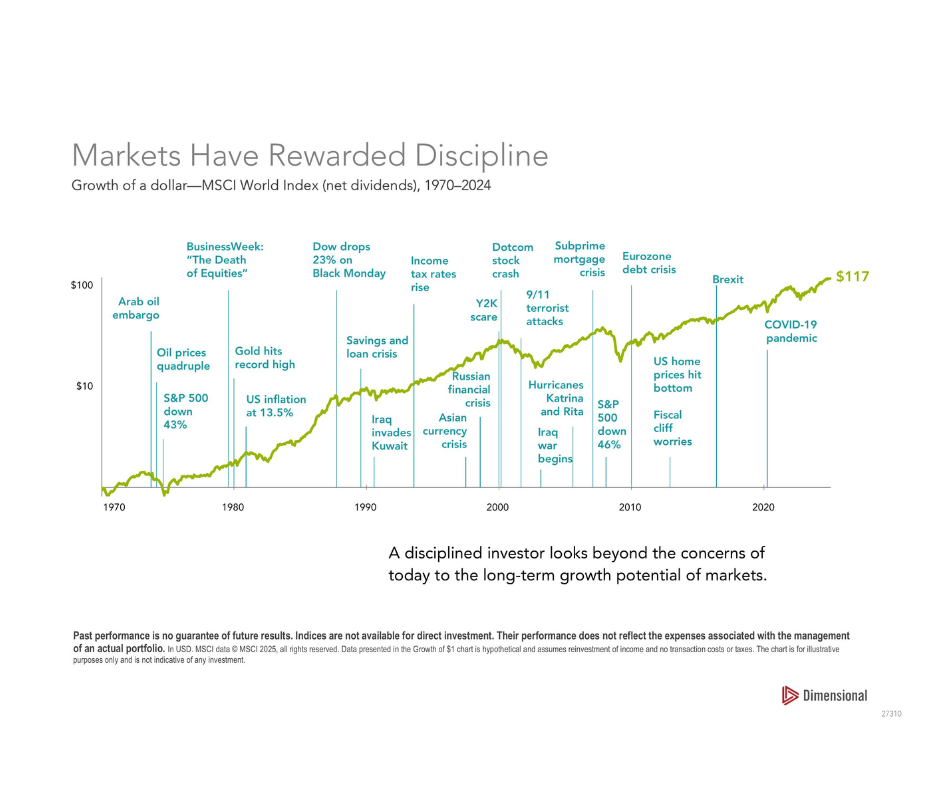

As always in times of such volatility, it’s natural to feel anxious about your investments. The rapid swings in stock prices can stir emotions, but it’s essential to remember that historically markets have demonstrated resilience over the long term, even in the face of policy-induced volatility.

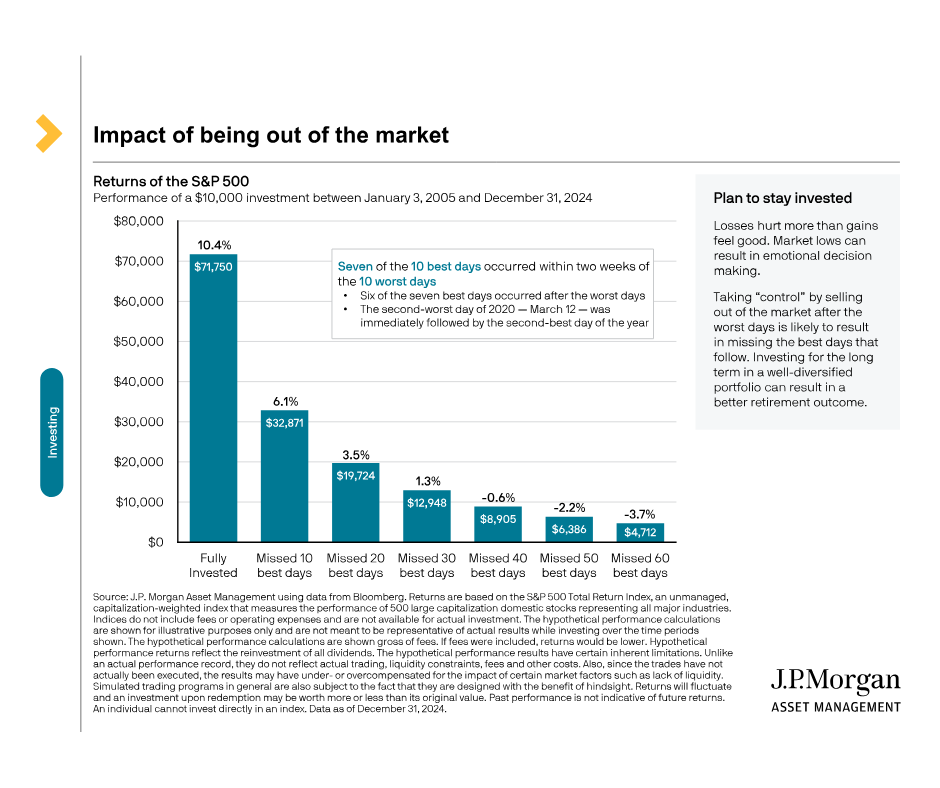

J.P. Morgan Asset Management’s oft-quoted research illustrates the importance of staying invested through turbulent periods. In one study, they analyzed the performance of a $10,000 investment in the S&P 500 between January 2004 and December 2023. If the investor stayed fully invested, the average annual return was 10.4%. However, missing just the 10 best days during that period cut the return to 6.1%. Missing the 20 best days dropped it further to 3.5% (see the data here). The impact of being out of the market for even a few key days—most of which tend to occur during periods of heightened volatility—can be dramatic.

“The stock market is a device for transferring money from the impatient to the patient” – Warren Buffett.

As the ‘Oracle of Omaha’ reminds us in the above quote, it’s important to keep in mind the psychological impact of market volatility. Behavioral finance studies suggest that the pain of losses often feels more intense than the pleasure of gains—a concept known as loss aversion. This can lead to panic selling, which often locks in losses and prevents investors from participating in subsequent market recoveries. Staying focused on your long-term goals and resisting the urge to make hasty decisions can help you avoid these pitfalls.

While this is the largest wave of American tariffs since President Hoover signed the Smoot-Hawley Tariff Act in 1930, it’s essential for us to maintain a long-term perspective. Reacting in fear or attempting to time the market during such periods can lead to missed opportunities and diminished returns. By staying the course and focusing on your long-term investment objectives, you position yourself to navigate through this volatility more effectively. Please see below for helpful graphic information on the value of staying the course.

As always, our team is here to support you in aligning your investment strategy with your financial goals, helping you navigate these uncertain times. Be on the lookout for additional communications and resources from our office in the coming days. In the meantime, we are available to talk if you’d like to reach out and discuss anything on your mind.

- 1

- 1-1 of 1 results